Sales Funnel for Financial Services: Turn Leads into Loyal Clients

A well-structured Sales Funnel for Financial Services is one of the most powerful tools for advisors, planners, agents, and financial professionals. It guides prospects from first discovery to long-term commitment through trust-building, education, and personalized communication. Because financial services require confidence and credibility, a funnel ensures that every prospect experiences a clear and supportive journey.

What Is a Sales Funnel for Financial Services?

A Sales Funnel for Financial Services is a step-by-step process designed to guide potential clients from awareness to becoming loyal, long-term customers. It works by nurturing leads with helpful education, strategic interactions, and personalized communication—and according to one benchmark study, the financial services industry sees about 29% of leads advance from “lead” to “marketing qualified lead (MQL)”. Financial services require trust, and a funnel creates a gradual experience that builds confidence at every stage.

Financial advisors, tax consultants, wealth managers, accountants, loan officers, insurance brokers, and financial firms all benefit from using a structured funnel. By defining each step clearly, they improve lead quality, increase conversions, and reduce the uncertainty of client acquisition. A funnel ensures prospects move smoothly from curiosity to informed decision-making.

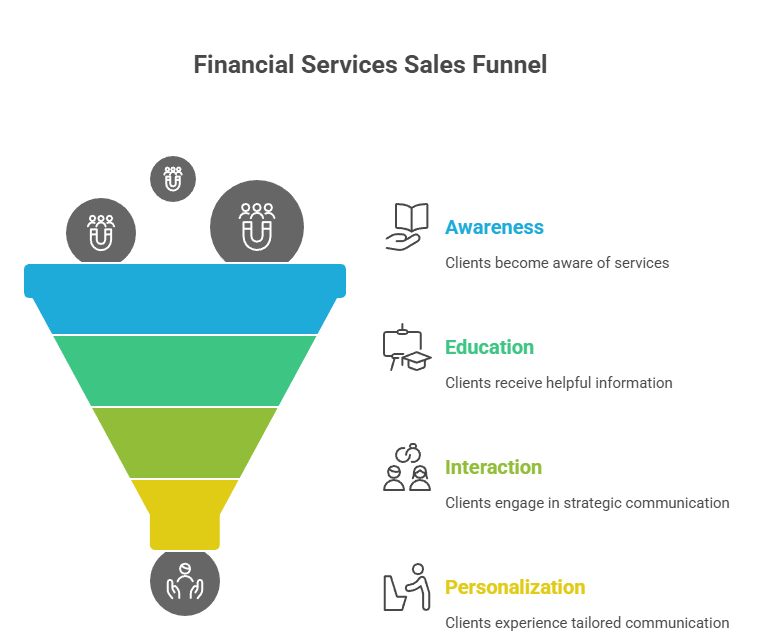

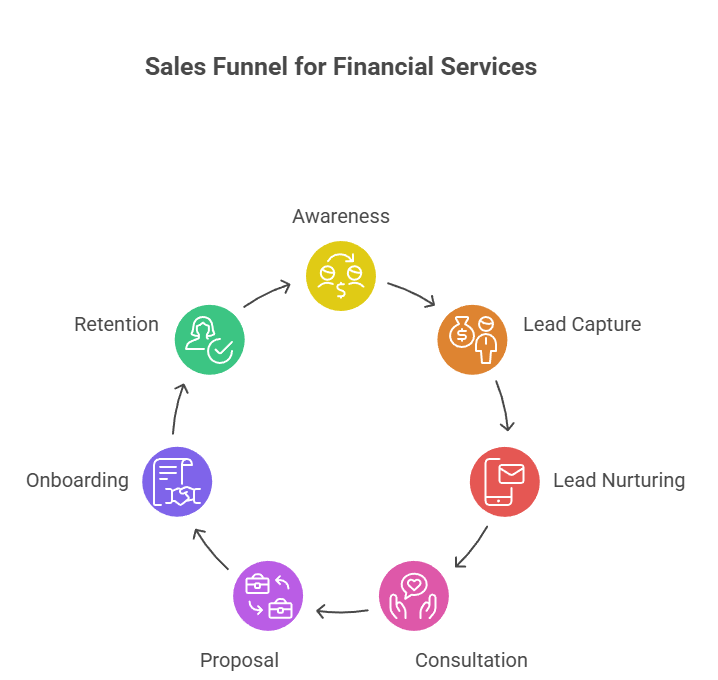

How a Sales Funnel for Financial Services Works

A Sales Funnel for Financial Services works by guiding prospects through a series of intentional stages that build trust, deliver value, and encourage action. Each stage has a unique purpose, helping prospects understand why your services matter and how you can support their financial goals. When these stages are aligned, the funnel becomes a predictable system for attracting and converting clients.

1. Awareness Stage

The awareness stage introduces prospects to your services through marketing channels they already use. They learn about your expertise through ads, blogs, webinars, social media content, or referrals that highlight your financial knowledge. This stage focuses on visibility and positioning you as a trustworthy professional.

2. Lead Capture

Lead capture transforms interested prospects into actual leads by collecting their contact information. This happens through valuable financial resources like ebooks, templates, checklists, and guides that address common money challenges—and on average, lead-magnet landing pages convert at around 18 % of visitors, showing the strong potential of a well-designed offer. When prospects download these resources, they signal a strong interest and enter your marketing system.

3. Lead Nurturing

Lead nurturing builds trust through consistent, automated communication designed to educate and support prospects. Emails, case studies, and helpful insights show that you understand their financial concerns and have the expertise to solve them. This stage warms prospects up until they feel ready to book a consultation.

4. Consultation or Discovery Call

During the consultation stage, prospects meet with you to discuss their financial goals, challenges, and expectations. This conversation allows you to uncover their priorities while showing your ability to guide them effectively. It’s a crucial step because clients often need a personal connection before committing to financial services.

5. Proposal & Presentation

In this stage, you present customized financial recommendations that align with the client’s goals. Your proposal outlines strategies, deliverables, pricing, and timelines so the client can clearly understand what they will receive. A strong proposal builds confidence by showing exactly how your services will improve their financial situation.

6. Onboarding

Onboarding transitions a committed prospect into an active client through organized processes and clear instructions. This includes signing agreements, completing forms, submitting documents, and receiving a welcome package. A smooth onboarding experience reassures the client that they made the right decision.

7. Retention & Upsell

Retention focuses on keeping clients engaged, supported, and satisfied through ongoing communication and progress evaluations. Regular check-ins, newsletters, service updates, and performance reviews strengthen long-term relationships. This stage also introduces clients to additional services like wealth management, retirement planning, or tax strategy upgrades.

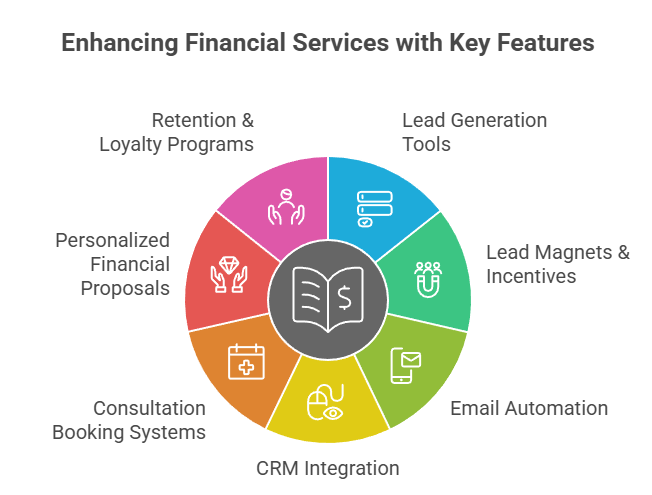

Key Features of a Sales Funnel for Financial Services

A Sales Funnel for Financial Services includes essential tools that improve lead generation, communication, and conversions. These features help create a seamless experience for prospects while making your workflow more efficient. When combined, they form a powerful system that supports consistent business growth.

1. Lead Generation Tools

Lead generation tools bring new prospects into your funnel through strategic marketing activities. Landing pages, online ads, SEO content, calculators, and webinars help attract people interested in financial solutions. These tools ensure you consistently reach audiences who need your expertise.

2. Lead Magnets & Incentives

Lead magnets offer valuable resources that encourage prospects to share their contact information. Financial downloads like budget templates, retirement checklists, or investment guides provide immediate, practical help. By offering real value upfront, you attract motivated prospects who are more likely to convert.

3. Email Automation

Email automation allows you to nurture leads without constant manual work. Automated messages provide consistent education, insights, and support that gradually build trust. With the right sequence, prospects are guided naturally toward booking a consultation.

4. CRM Integration

CRM systems organize your leads and track every interaction to ensure no opportunity is missed. They provide insight into how prospects behave, what they’re interested in, and when to follow up. With this information, you can create more personalized and effective communication.

5. Consultation Booking Systems

Booking systems simplify the process of scheduling meetings by letting prospects choose available time slots online. They eliminate back-and-forth messages and give clients a convenient way to connect with you. This increases the likelihood of consultations and faster conversions.

6. Personalized Financial Proposals

Personalized proposals tailor your financial recommendations to each client’s goals and situation. They show exactly how your solutions address the client’s needs and provide clear details about pricing and expectations. This customization strengthens trust and boosts conversion rates.

7. Retention & Loyalty Programs

Retention programs keep clients engaged through continuous communication, reviews, and exclusive services. These programs help strengthen long-term relationships and encourage ongoing business. Loyal clients often refer others, increasing your pipeline with minimal effort.

Benefits of Using a Sales Funnel for Financial Services

A Sales Funnel for Financial Services offers powerful benefits that enhance your marketing, lead quality, and client experience. It creates a predictable process for attracting, nurturing, and converting clients. This structure allows financial professionals to grow sustainably and efficiently.

1. Build Trust Step-by-Step

A funnel creates trust by educating prospects gradually rather than rushing them into decisions. Clients feel more comfortable when they understand your knowledge and see your value over time. This slow-build approach is especially effective in financial industries where trust is essential.

2. Higher Quality Leads

Lead magnets attract prospects who genuinely need financial support and are actively searching for answers. These high-intent leads are easier to convert compared to general audiences. You spend less time chasing uninterested people and more time serving qualified clients.

3. Better Conversion Rates

A structured funnel gives prospects a clear path to follow, removing confusion and uncertainty. Each step guides them closer to scheduling a call or enrolling in your services. This increases overall conversions and reduces the guesswork in your sales process.

4. Automated Lead Nurturing

Automation allows your funnel to work continuously without requiring constant attention. Emails, reminders, and follow-up messages run on their own and keep prospects engaged. This saves time while improving consistency and professionalism.

5. Improved Client Retention

Regular communication keeps clients informed, reassured, and satisfied with your services. Ongoing touchpoints like reviews and updates strengthen long-term loyalty. Retention leads to repeat business, referrals, and higher lifetime value.

6. Scalable Client Acquisition

Once your funnel is set up, it continues to attract and convert leads automatically. This creates predictable growth without needing constant manual effort. With scalability, your business can grow steadily while maintaining high service quality.

Sales Funnel for Financial Services vs Traditional Sales

A sales funnel offers more structure, automation, and predictability compared to traditional selling methods. Traditional sales rely heavily on manual outreach, inconsistent follow-ups, and limited long-term planning. A funnel provides a modern, efficient approach that leads to stronger client relationships.

| Feature | Sales Funnel | Traditional Sales |

|---|---|---|

| Trust Building | Gradual education builds confidence | Trust is harder to build instantly |

| Lead Quality | Highly targeted and motivated leads | Mixed and unpredictable lead quality |

| Conversion Rate | Increased due to structured nurturing | Lower due to inconsistent follow-ups |

| Automation | Automated emails and CRM tools | Mostly manual processes |

| Cost Efficiency | Lower long-term cost and effort | Higher ongoing effort |

| Client Retention | Strong focus on long-term relationships | Minimal retention strategies |

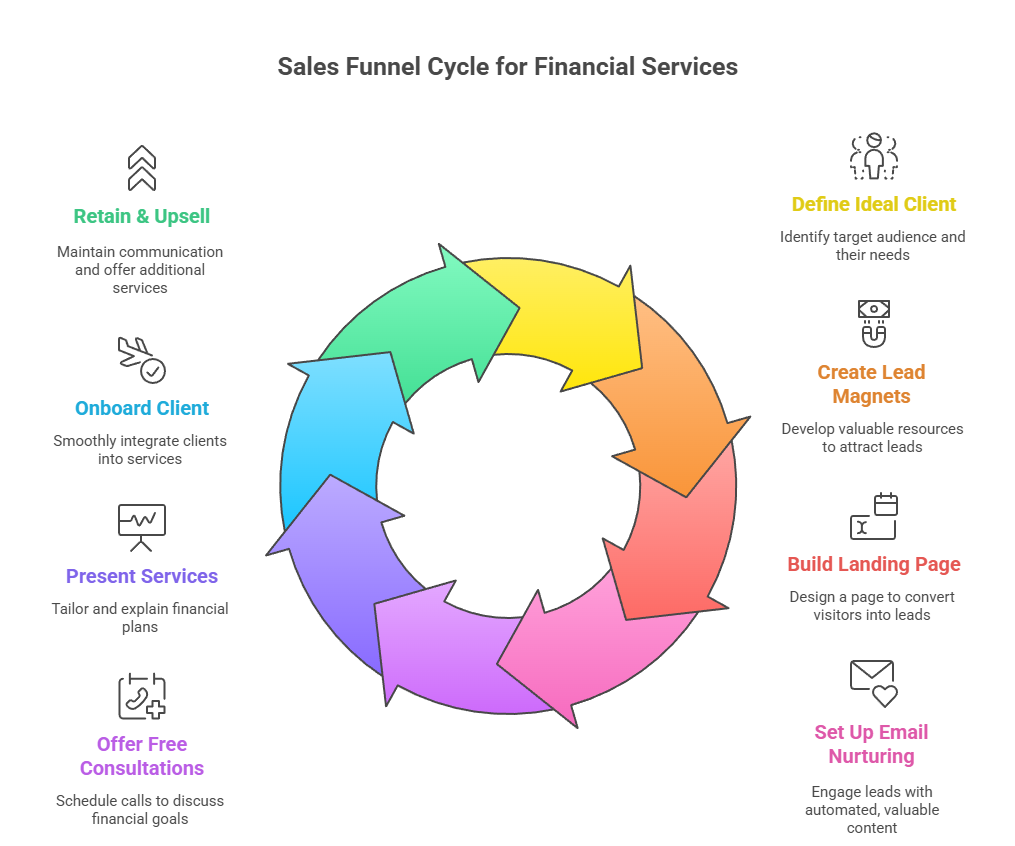

How to Build a Sales Funnel for Financial Services

Building a Sales Funnel for Financial Services involves clear planning and strategic execution. Each step contributes to a complete client journey that improves conversions and retention. By following these steps, you can create a predictable and high-performing funnel.

Step 1: Define Your Ideal Client

Start by identifying your ideal audience, such as retirees, business owners, families, or investors. Understanding their financial challenges helps you create targeted messages and offers. The clearer your audience, the more effective your funnel becomes.

Step 2: Create Lead Magnets

Develop high-value financial resources that address your audience’s most common concerns. These can include investment guides, tax strategies, credit score tips, or retirement checklists. A strong lead magnet encourages prospects to join your funnel quickly.

Step 3: Build a Landing Page

A landing page presents your lead magnet and encourages prospects to sign up. It uses simple messaging, compelling benefits, and a clear call-to-action. The goal is to convert visitors into leads efficiently.

Step 4: Set Up Email Nurturing

Email nurturing delivers consistent value through automated messages that educate and engage prospects. These emails share insights, stories, and financial tips that reinforce your expertise. Over time, your audience becomes more prepared to work with you.

Step 5: Offer Free Consultations

Invite warm leads to schedule a discovery call where you discuss their financial goals. Booking tools make scheduling simple and reduce friction. These calls help solidify trust and accelerate decision-making.

Step 6: Present Your Services

During this stage, present a customized financial plan tailored to the prospect’s unique needs. Explain your process, strategies, and pricing clearly so they understand the benefits. A strong presentation moves prospects confidently toward enrollment.

Step 7: Onboard the Client

Onboarding ensures clients transition smoothly into your service workflow by providing clear instructions and necessary forms. This professional experience reassures clients and sets the tone for your partnership. A strong onboarding process improves satisfaction immediately.

Step 8: Retain & Upsell

Maintain ongoing communication through reviews, updates, and personalized support. Offer additional services such as tax planning or wealth management as clients’ needs grow. Retention strengthens long-term business stability and increases lifetime value.

Limitations of a Sales Funnel for Financial Services

Even with many advantages, a Sales Funnel for Financial Services has limitations worth considering. Understanding these challenges helps you optimize your strategy. Here are key limitations every financial professional should be aware of.

1. Requires Compliance

Financial marketing must follow strict regulatory guidelines to ensure accuracy and ethical communication. This means not all marketing tactics used in other industries can be applied freely. Compliance must be prioritized at every stage of the funnel.

2. Needs Consistent Content

Because financial topics evolve, your educational content must remain updated. Outdated guidance can harm trust and reduce effectiveness. Consistent content creation is essential for maintaining relevance.

3. Longer Conversion Cycles

Financial decisions require more time, careful thinking, and trust than typical purchases. Prospects often take weeks or months to commit. Patience and consistent nurturing are vital to long-term success.

TaskVirtual: Your Partner in Sales Funnel Support for Financial Professionals

Managing a strong financial services funnel requires ongoing tasks like lead tracking, email management, scheduling consultations, and maintaining consistent communication—all of which can become overwhelming for busy advisors. TaskVirtual helps financial professionals stay organized by handling administrative and sales funnel-related support so you can focus on providing expert financial guidance. Their virtual assistants streamline your workflow, strengthen your client journey, and help maintain a smooth, effective funnel from lead capture to retention.

1. Expert Consultation and Review

TaskVirtual’s experienced virtual assistants help financial professionals evaluate funnel performance, organize leads, and manage follow-ups with precision. They also support the creation of financial content, call scheduling, and appointment reminders to keep prospects engaged. Their expertise ensures your funnel runs efficiently while you concentrate on client-facing activities.

2. Affordable and Flexible Pricing

Hiring in-house support can be expensive, but TaskVirtual offers a cost-effective alternative. With pricing plans starting from $3.12/hour to $14.99/hour, their services are accessible for solo advisors, small firms, and large financial practices alike. This affordable structure allows you to scale support as your funnel grows.

3. Comprehensive Funnel Management Solutions

TaskVirtual assists with lead nurturing tasks such as CRM updates, email sequencing, calendar management, and organizing financial resources for prospects. Their virtual assistants also help prepare proposals, manage documentation, and coordinate onboarding. Whether you need consistent daily support or occasional help, TaskVirtual adapts to your workflow.

4. Ongoing Support and Quality Assurance

Beyond administrative work, TaskVirtual provides proactive updates, reminders, and quality checks to ensure every prospect receives timely communication. Their continuous support helps prevent missed opportunities and maintains a professional, seamless funnel experience. This level of reliability keeps your client journey strong from start to finish.

5. Proven Track Record of Excellence

With 364 positive reviews and an outstanding 4.7-star rating, TaskVirtual has earned global recognition as a trusted virtual assistance provider. Financial advisors rely on their dependable support to simplify operations, streamline funnel management, and increase overall productivity. Their reputation highlights their commitment to delivering high-quality service every time.

Final Thoughts on Sales Funnels for Financial Services

A Sales Funnel for Financial Services is one of the most effective tools for attracting, nurturing, and converting clients. By providing value at every stage, you build trust, improve lead quality, and create stronger long-term relationships. Whether you’re an independent advisor or part of a financial firm, a funnel offers predictable growth and stability.

FAQ: Sales Funnel for Financial Services

1. What is a Sales Funnel for Financial Services?

A process that guides prospects from awareness to becoming long-term financial clients.

2. Why do financial advisors need a sales funnel?

It builds trust, increases lead quality, and improves conversion rates.

3. What can you use as a lead magnet?

Financial guides, checklists, templates, e-books, calculators, and webinars.

4. Can the funnel be automated?

Yes, email sequences, reminders, and CRM workflows can all run automatically.

5. How long does conversion take?

It can take days to months, depending on the prospect’s financial needs and trust level.