QuickBooks Virtual Assistance: A Smarter Way to Manage Your Business Finances

QuickBooks has become the global standard for small-business accounting, providing tools for bookkeeping, invoicing, payroll, financial reporting, and cash flow management. With over 7 million global subscribers, QuickBooks dominates the financial software market because of its flexibility and industry-wide acceptance.

However, managing QuickBooks efficiently is time-consuming. Business owners often struggle to balance financial tasks with daily operations. According to SCORE, 40% of small business owners say bookkeeping and taxes are the worst part of running a business.

This is where a QuickBooks virtual assistant becomes transformational — offering businesses timely, accurate, and cost-effective financial support without the need to hire a full-time accountant.

What Is a QuickBooks Virtual Assistant

A QuickBooks virtual assistant is a trained professional who specializes in managing accounting tasks inside QuickBooks Online or QuickBooks Desktop. They help business owners stay compliant, organized, and financially aware by handling bookkeeping, invoicing, reconciliation, and reporting.

According to Intuit’s business insights, QuickBooks automation and support help companies reduce manual accounting errors by up to 75% — proving how essential structured bookkeeping is.

A QuickBooks VA ensures your books are accurate, updated, and audit-ready at all times.

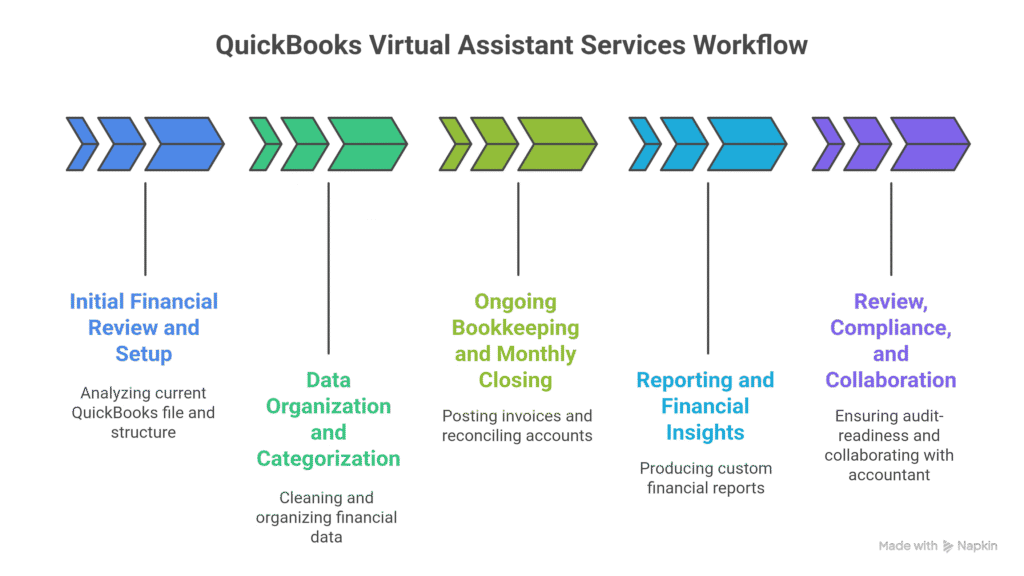

How QuickBooks Virtual Assistant Services Work

QuickBooks virtual assistants follow a structured financial workflow designed to keep business financials organized, compliant, and ready for decision-making.

Below is an outline of how these services typically operate.

1. Initial Financial Review and Setup

A VA begins by analyzing your current QuickBooks file, chart of accounts, and bookkeeping structure. They identify gaps, errors, duplications, and missing entries.

2. Data Organization and Categorization

VAs clean financial data, categorize transactions, update vendor lists, and organize income and expense records based on accounting standards.

3. Ongoing Bookkeeping and Monthly Closing

On a daily, weekly, or monthly basis, VAs post invoices, reconcile bank accounts, prepare reports, and keep your books current.

4. Reporting and Financial Insights

Assistants produce custom reports such as P&L, balance sheets, cash flow summaries, A/P, and A/R reports for review.

5. Review, Compliance, and Collaboration with Your Accountant

The VA ensures your books remain audit-ready and collaborates with your accountant for tax preparation and year-end closing.

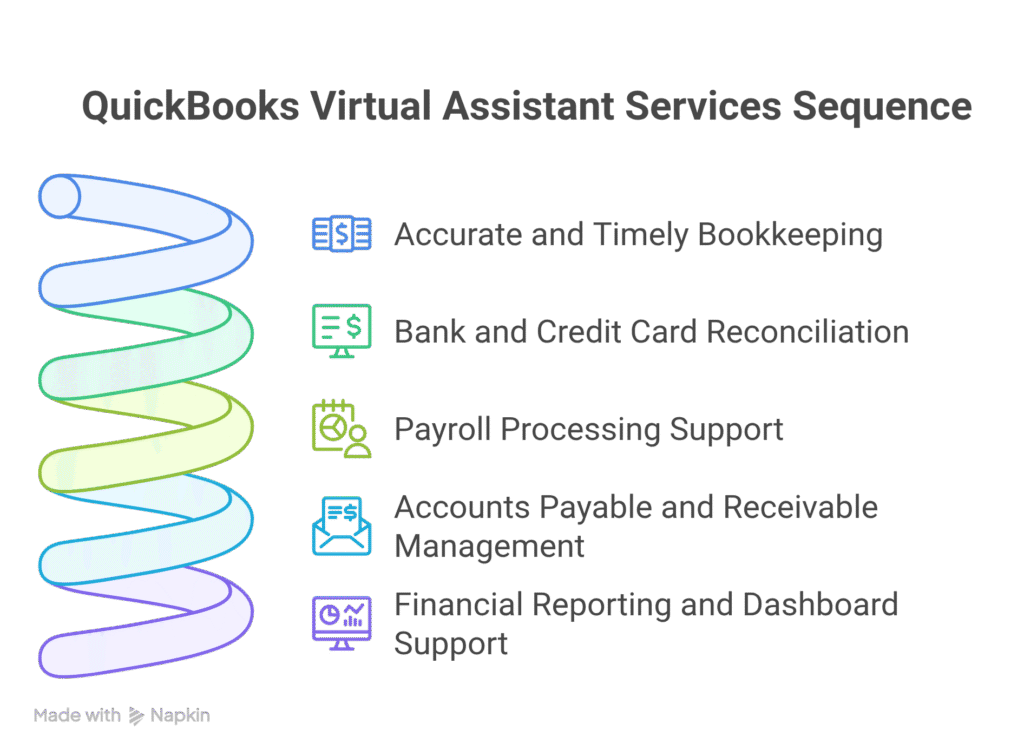

Key Features of QuickBooks Virtual Assistant Services

QuickBooks virtual assistant services include multiple components that strengthen your financial infrastructure and reduce operational burden.

Below are the essential features included in these services.

1. Accurate and Timely Bookkeeping

VAs maintain transaction accuracy and ensure books remain up-to-date for smooth financial operations.

2. Bank and Credit Card Reconciliation

Reconciliation prevents errors, fraud, and duplicate entries. The National Taxpayer Advocate reports that reconciliation reduces financial discrepancies by up to 30%.

3. Payroll Processing Support

Virtual assistants help organize payroll data, prepare payroll runs, and ensure compliance with local regulations.

4. Accounts Payable and Receivable Management

From invoice preparation to follow-ups, VAs manage billing cycles and vendor payments efficiently.

5. Financial Reporting and Dashboard Support

They generate detailed reports and create dashboards for financial forecasting and performance evaluation.

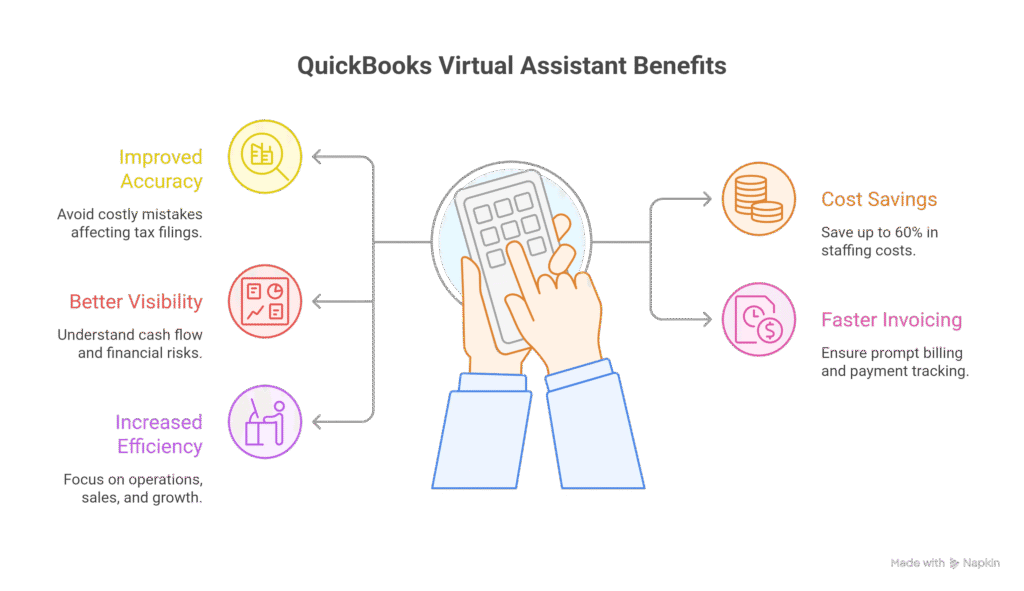

Benefits of QuickBooks Virtual Assistant Services

Using a QuickBooks virtual assistant offers a wide range of advantages that support long-term financial stability and growth.

Below are the most significant benefits for businesses.

1. Improved Accuracy and Reduced Accounting Errors

With expert oversight, businesses avoid costly mistakes that could affect tax filings and financial decisions.

2. Cost Savings Compared to Hiring In-house Staff

Outsourcing accounting tasks can save up to 60% in staffing costs, giving small businesses affordable access to professional bookkeeping.

3. Better Financial Visibility and Decision-Making

Real-time QuickBooks updates help business owners understand cash flow, profitability, and financial risks.

4. Faster Invoicing and Payment Cycles

VAs ensure clients are billed promptly and payments are tracked, improving cash flow stability.

5. Increased Efficiency and Reduced Workload

With a QuickBooks VA managing finances, business owners can focus on operations, sales, and growth.

How to Implement QuickBooks Virtual Assistant Services for Your Business

Hiring and integrating a QuickBooks VA requires a structured approach for maximum impact.

Below is the recommended process businesses follow.

1. Identify Your Accounting Needs and Workflow Gaps

Determine which tasks consume the most time or cause the most errors.

2. Grant Secure Access to QuickBooks

Provide restricted access based on role requirements and activate two-factor authentication.

3. Set Up Monthly Reporting and Deadlines

Monthly or weekly reporting schedules keep financials current and reliable.

4. Align on Bookkeeping Categories and Financial Rules

VAs follow standardized categorization to maintain audit-ready records.

5. Monitor Progress and Improve Your Accounting System

Frequent reviews enhance accuracy and streamline accounting workflows over time.

How Virtual Assistants Help in QuickBooks Management

Virtual assistants play a crucial role in modern bookkeeping systems by performing detail-oriented tasks that ensure smooth accounting operations.

Below are the primary ways VAs support QuickBooks management.

1. Daily and Monthly Bookkeeping Support

VAs categorize expenses, record sales, track payments, and maintain accurate books.

2. Invoicing, Billing, and Collections Support

They prepare invoices, track overdue payments, and send reminders to clients.

3. Financial Data Cleanup and Catch-up Bookkeeping

Businesses with outdated books rely on VAs to correct historical data and reconstruct accurate records.

4. Bank Reconciliation and Financial Review

Assistants match entries, detect errors, and maintain financial consistency.

5. Reporting and Performance Insights

VAs prepare P&L, balance sheet, cash flow, and custom business reports to support analysis.

TaskVirtual: Your Partner in QuickBooks Virtual Assistant Services

At TaskVirtual, we provide accounting services through professional QuickBooks virtual assistants who deliver accurate, reliable, and timely bookkeeping support for businesses across industries.

Our QuickBooks-trained VAs specialize in:

- Daily bookkeeping and transaction posting

- Bank and card reconciliation

- Invoicing, A/P, and A/R support

- Expense categorization

- Payroll preparation assistance

- Financial reporting and dashboards

- Historical cleanup and catch-up bookkeeping

- Collaboration with your accountant or CPA

With 364+ positive client reviews and a 4.7-star satisfaction rating, TaskVirtual offers trustworthy, detail-oriented financial support starting at just $3.12 per hour — enabling businesses to maintain flawless books without hiring full-time accountants.

Final Thoughts on QuickBooks Virtual Assistant Services

QuickBooks virtual assistants offer tremendous value to businesses by improving accuracy, enhancing financial clarity, and reducing operational burdens. They help companies stay compliant, invoice faster, track expenses, reconcile accounts, and prepare insightful reports — all while keeping costs low.

With a dedicated QuickBooks VA, business owners can focus on operations and growth without worrying about complex accounting tasks.

TaskVirtual delivers the expertise, consistency, and affordability needed to maintain a clean, organized, and reliable financial structure.

FAQs

1. What does a QuickBooks virtual assistant do?

They manage bookkeeping, invoicing, reconciliation, reporting, and financial organization inside QuickBooks.

2. Can a VA handle QuickBooks Online and Desktop?

Yes — TaskVirtual VAs are trained in both versions.

3. Is it safe to give a VA access to QuickBooks?

Yes, with restricted user roles, 2FA, and encrypted access protocols.

4. Can a VA help clean up messy or outdated books?

Absolutely — catch-up bookkeeping is one of the most common QuickBooks VA services.

5. Why choose TaskVirtual for QuickBooks support?

Because TaskVirtual offers skilled, affordable, and highly trained QuickBooks VAs who maintain accuracy, speed, and professional financial reporting.