How to Hire a Virtual Assistant for Accountant Tasks: A Complete Guide

In an era where productivity, precision, and cost-efficiency define business success, accountants and finance professionals are increasingly turning to virtual assistants (VAs) for support. Whether you’re a CPA managing multiple clients or a CFO overseeing a lean finance team, a qualified virtual assistant can help you reclaim time, reduce costs, and streamline operations. But how to hire a virtual assistant for accountant tasks—without risking your financial data or compliance obligations?

This blog walks you through the step-by-step process, with expert tips, industry statistics, and a smart resource recommendation at the end.

Why Accountants Are Hiring Virtual Assistants in 2025

The demand for specialized virtual assistants in accounting is at an all-time high. According to a recent report, the virtual assistant services market is expected to exceed $19.6 billion globally by 2028, with growing adoption across finance, legal, and healthcare sectors.

Key reasons why accountants in the US and UK are outsourcing to VAs:

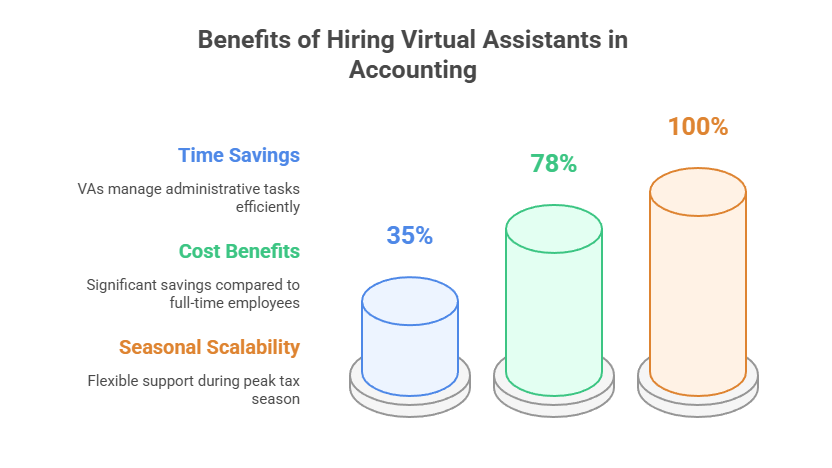

1. Time savings:

VAs can manage 30–40% of administrative and data-entry tasks, freeing up time for strategic analysis and client consulting.

2. Cost benefits:

Businesses save up to 78% in operational costs when hiring remote VAs versus full-time employees, according to Outsource Access.

3. Seasonal scalability:

Firms ramp up support during tax season without long-term commitments.

With hybrid and remote workflows becoming standard, hiring a VA is now a strategic move—not just a cost-cutting measure.

Step-by-Step: How to Hire a Virtual Assistant for Accounting Tasks

1. Identify Your Specific Needs

Before you even post a job listing, clarify what kind of support you need. Common virtual assistant tasks for accountants include:

-

Bookkeeping and bank reconciliation

-

Invoicing and billing support

-

Accounts receivable and payable tracking

-

Data entry and spreadsheet management

-

Client communication and scheduling

-

Preparing reports and tax documents

Ask yourself:

-

Are these daily or weekly tasks?

-

Do they involve sensitive data?

-

Are industry-specific tools like QuickBooks, Xero, or Sage required?

A good VA job description begins with a focused task list—vague expectations lead to miscommunication and inefficiencies.

2. Choose the Right Platform or Agency

You can hire VAs from freelance platforms, job boards, or specialized agencies. Each has pros and cons:

For financial services, it’s safer to go with pre-vetted virtual assistants from agencies, as they typically have built-in compliance training, contract safeguards, and NDAs.

3. Evaluate Accounting Expertise and Tech Skills

Look for VAs with previous experience in accounting or finance roles. Essential skills and software knowledge include:

Tools:

Proficiency in QuickBooks, FreshBooks, Xero, Wave, Excel, or Zoho Books.

Terminology:

Understanding of general ledgers, cash flow, accruals, tax codes, and audits.

Security:

Familiarity with secure file sharing, 2FA systems, and role-based permissions.

You can even ask them to complete a brief test task such as a simulated invoice entry or reconciled ledger to assess accuracy and software fluency.

According to RemoteCo, businesses that use skill assessments during hiring report 34% higher VA success rates.

4. Run Background Checks and Interviews

Vetting for trustworthiness is crucial—your assistant will handle financial data. During the interview:

-

Ask about confidentiality and prior exposure to sensitive information.

-

Request references or client testimonials.

-

Confirm their understanding of UK’s HMRC protocols or US IRS tax frameworks, depending on your region.

Also, check if they can work during your business hours or offer overlap. A common issue with offshore hires is the time-zone disconnect that hampers real-time communication.

5. Onboard with Clear SOPs and Role Definitions

A seamless onboarding process avoids friction and ensures productivity from day one. Share:

-

A written SOP (standard operating procedure) for each task

-

Account credentials via password-sharing tools like LastPass

-

Communication channels (Slack, Teams, Email)

Set expectations for reporting and performance reviews. Weekly summaries and check-ins build long-term accountability.

Common Mistakes to Avoid When Hiring a VA

Even experienced accountants can make these missteps:

-

Overloading the VA with mixed tasks like marketing, admin, and bookkeeping

-

Skipping the trial phase, leading to poor fit

-

Failing to define KPIs such as hours saved, tasks completed, or error rate

-

Hiring based on low cost alone, which often backfires

Remember, your virtual assistant is an extension of your financial team. A well-trained VA should be treated and supported as such.

How TaskVirtual Can Help You Hire the Right Accounting VA

When it comes to hiring a virtual assistant for accounting services, TaskVirtual stands out as a reliable partner for businesses in the US and UK. Here’s how they make a difference:

1. Expert Consultation

TaskVirtual provides a free consultation to help you assess what type of VA you need—be it for daily bookkeeping, tax support, or billing cycle management. Their advisors understand both US (IRS) and UK (HMRC) compliance frameworks.

2. Affordable Pricing

With hourly rates starting from $3.12 to $14.99, you get access to experienced professionals at a fraction of what local hires would cost. This is ideal for startups, solo CPAs, and growing finance teams.

3. Proven Track Record

TaskVirtual has received 364 verified 5-star reviews and boasts a 4.7-star rating on leading VA platforms. Their VAs are trained on QuickBooks, Xero, Excel, and Zoho—ensuring high-quality output from day one.

4. Secure & Scalable

You can scale up support during tax seasons or audits without hiring full-time employees. TaskVirtual ensures NDAs, encrypted file access, and two-step verification protocols for all client accounts.

Explore more at TaskVirtual.com.

Final Thoughts

So, how to hire a virtual assistant for accountant responsibilities in 2025? The answer lies in strategic delegation, smart screening, and structured onboarding. Whether you’re in the UK dealing with VAT filings or in the US closing quarterly books, the right VA can transform your workflow.

By outsourcing intelligently, you save time, reduce costs, and increase your billable capacity—all without compromising data integrity or client trust. If you’re ready to boost your accounting practice with a virtual assistant, start with a clear plan and consider trusted providers like TaskVirtual to get the job done right.