Why Hiring a Virtual Bookkeeping Assistant Is a Game-Changer for Growing Businesses

In today’s fast-paced digital economy, businesses in the US and UK are increasingly looking for smart ways to reduce costs, improve efficiency, and gain financial clarity. One strategic move reshaping how companies handle their finances is the growing reliance on a Virtual Bookkeeping Assistant. This role has quickly evolved from being a nice-to-have to a business-critical function, especially for startups, e-commerce ventures, and SMEs aiming to stay competitive without breaking the bank.

Understanding What a Virtual Bookkeeping Assistant Does

A Virtual Bookkeeping Assistant is a remote professional who manages financial records, transactions, invoicing, and reconciliations without being physically present in the office. Unlike traditional bookkeepers, they work from anywhere, leveraging cloud-based accounting tools like QuickBooks, Xero, and FreshBooks to maintain accuracy and compliance.

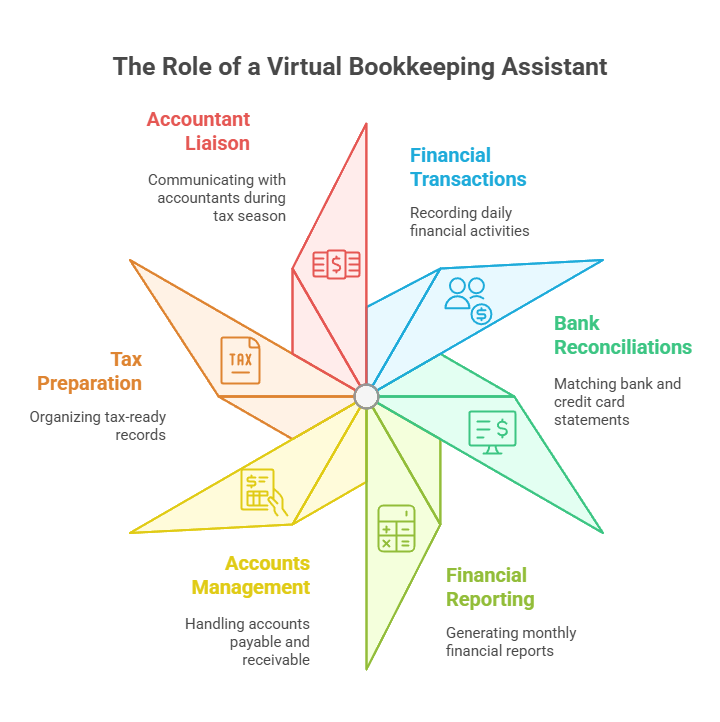

They typically handle:

-

Recording day-to-day financial transactions

-

Reconciling bank and credit card statements

-

Generating monthly financial reports

-

Managing accounts payable and receivable

-

Organizing tax-ready records

-

Liaising with your accountant during tax season

Thanks to cloud platforms and fintech integrations, these assistants can seamlessly plug into your financial operations without the need for expensive onboarding or desk space.

The Rising Demand for Virtual Bookkeeping Assistants

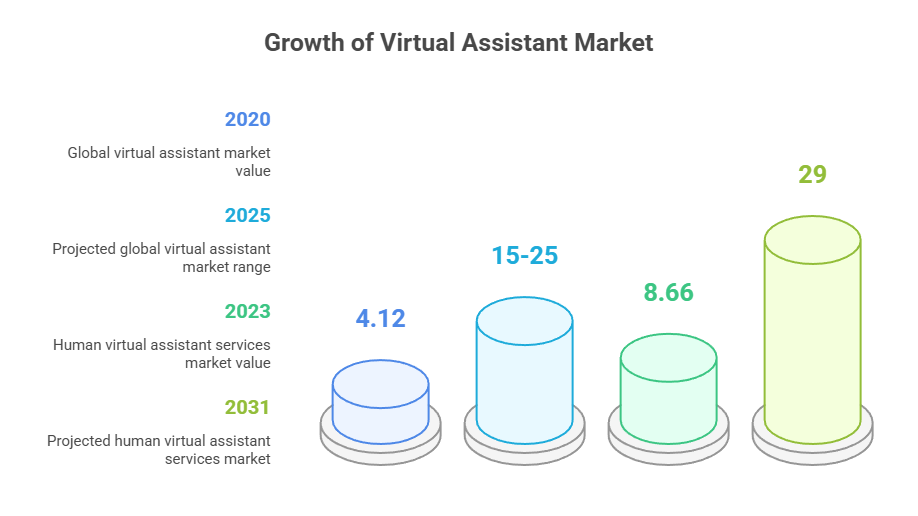

The market for virtual assistance is booming. The global virtual assistant market was valued at $4.12 billion in 2020 and is expected to reach between $15 billion $25 billion by 2025, growing at a CAGR of 24–34%. Specifically, the human virtual assistant services sector, which includes bookkeeping, stood at $8.66 billion in 2023 and is projected to reach $29 billion by 2031.

A large share of this growth is driven by small-to-medium enterprises (SMEs) in the US and UK seeking affordable, scalable solutions to maintain their books without hiring full-time, in-house staff. As the freelance economy expands, business owners are realizing that bookkeeping is one of the first departments they can—and should—outsource virtually.

Major Benefits of Hiring a Virtual Bookkeeping Assistant

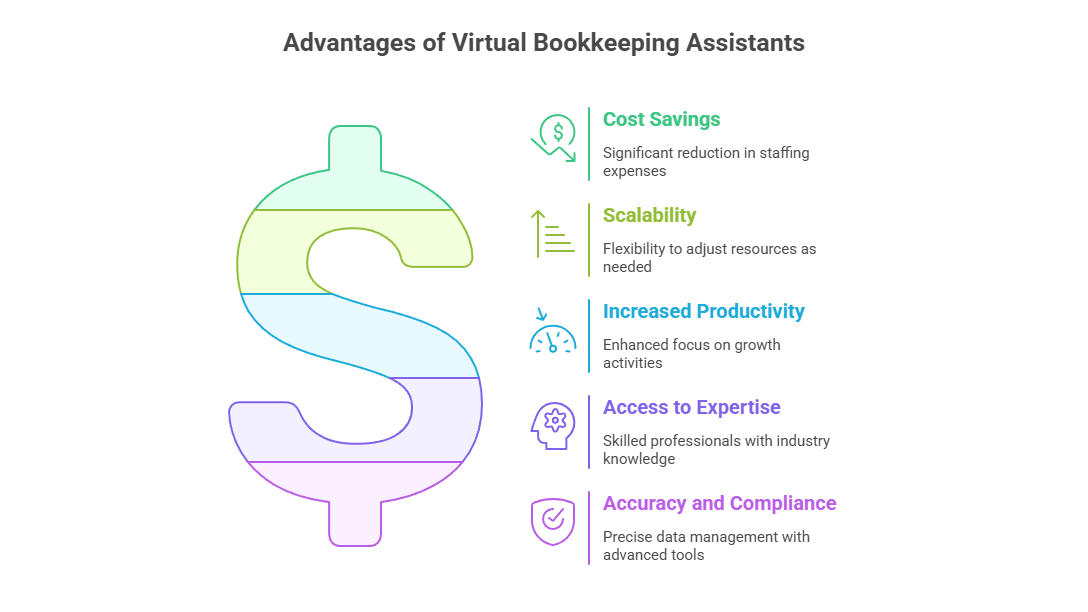

1. Substantial Cost Savings

Hiring a full-time, in-house bookkeeper can cost $45,000 to $65,000 annually, including benefits and overhead. In contrast, virtual assistants charge as little as $8–$15/hour offshore, or $25–$40/hour domestically, saving up to 70–78% on staffing costs.

2. Scalability Without Hiring Headaches

Virtual bookkeepers can scale up or down based on your needs—perfect for seasonal businesses or startups that can’t predict future growth. There are no long-term contracts, no benefits to manage, and no HR complexities.

3. Increased Productivity

According to business operations research, outsourcing administrative and financial tasks boosts productivity by over 35%, as business owners focus more on growth-oriented activities. You’re effectively buying back time to strategize, sell, and innovate.

4. Access to Expertise

Virtual bookkeeping assistants are often trained professionals, sometimes certified in accounting or finance, who work across industries. Many come equipped with knowledge of local tax regulations in both the US and UK, making them ideal allies during tax season.

5. Accuracy and Compliance

Thanks to real-time cloud accounting tools and AI-powered automations, virtual bookkeepers offer better precision than most in-house teams. Tools like Botkeeper and Dext can auto-categorize expenses and flag anomalies, while the VA reviews the data for accuracy.

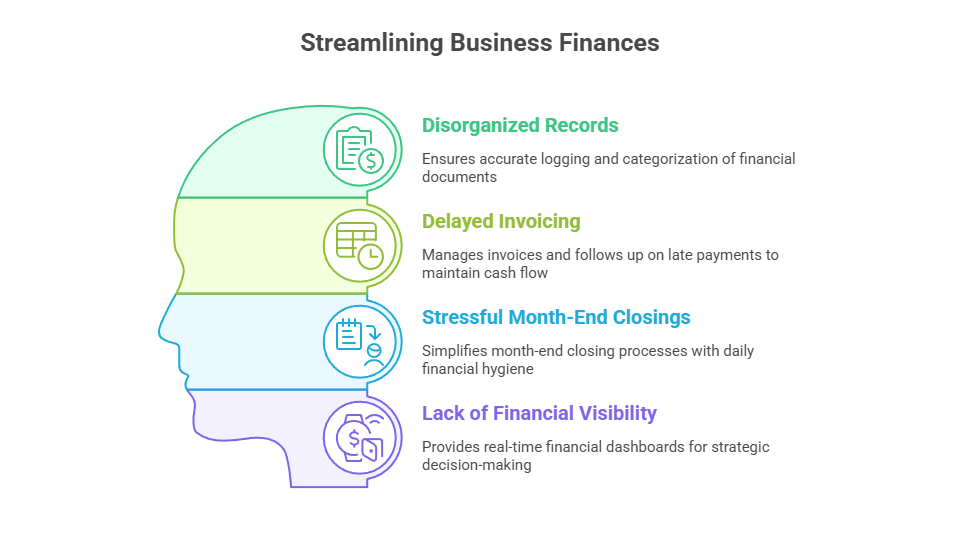

Challenges Solved by Virtual Bookkeeping Assistants

1. Disorganized Records:

They ensure every receipt, invoice, and transaction is logged and categorized correctly, making audits and tax filings seamless.

2. Delayed Invoicing:

Missed billing can crush cash flow. A virtual assistant keeps track of invoices and follows up on late payments.

3. Stressful Month-End Closings:

With a VA maintaining daily financial hygiene, closing the books at the end of each month becomes a 1-day task instead of a fire drill.

4. Lack of Financial Visibility:

With up-to-date dashboards, business owners can see their financial position in real time.

In short, they help create the foundation for strategic decision-making.

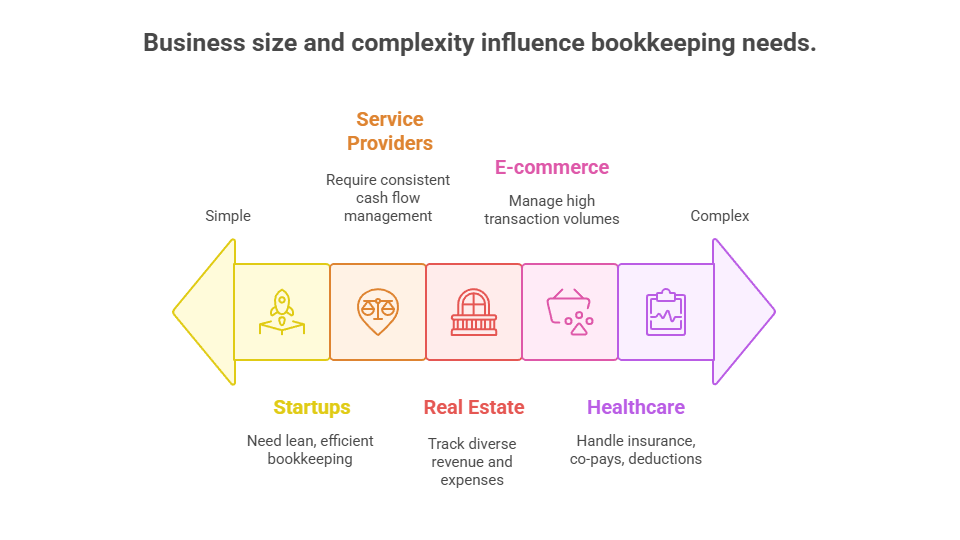

Who Should Hire a Virtual Bookkeeping Assistant?

While nearly every business can benefit from bookkeeping support, here are the key segments that see the biggest ROI:

-

E-commerce stores juggling thousands of transactions monthly

-

Startups and tech companies seeking lean operations

-

Professional service providers (law firms, consultants, designers) need consistent cash flow

-

Real estate firms tracking multiple revenue and expense streams

-

Healthcare and wellness practitioners managing insurance, co-pays, and tax deductions

For these businesses, having real-time financial clarity isn’t a luxury—it’s a necessity.

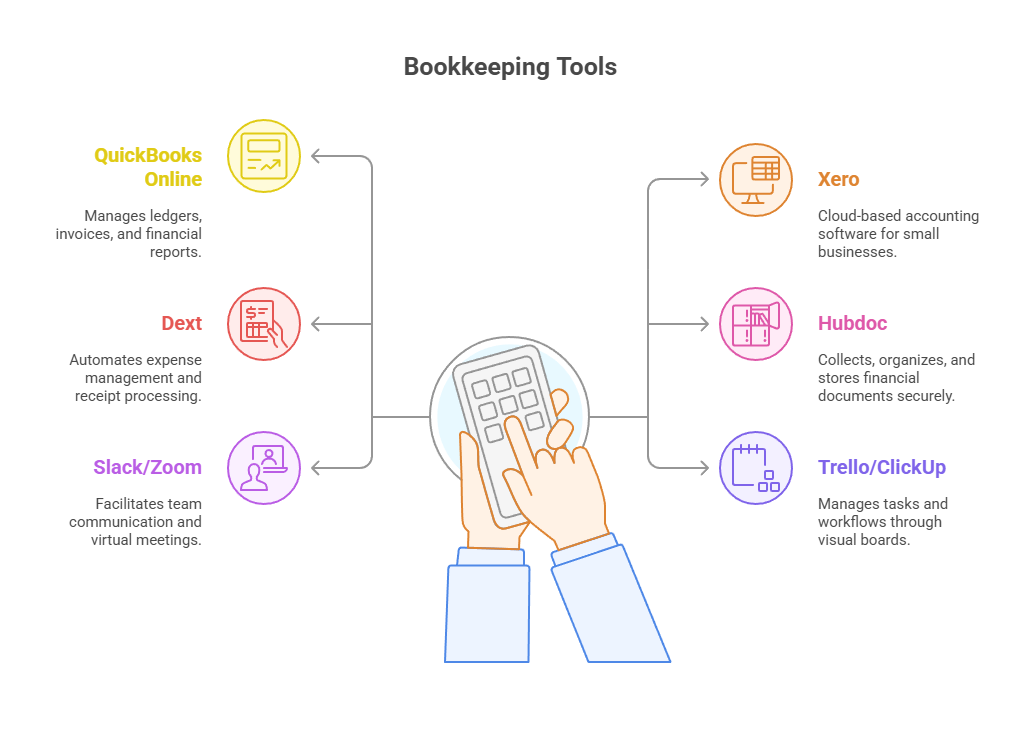

Tools Commonly Used by Virtual Bookkeeping Assistants

Modern virtual bookkeepers use a blend of tech tools that sync with your banking and POS systems:

1. QuickBooks Online –

Used for managing general ledgers, creating invoices, and generating financial reports.

2. Xero

A cloud-based accounting software designed for small business bookkeeping.

3. Dext (formerly Receipt Bank)

Automates expense management and streamlines receipt processing.

4. Hubdoc

Collects, organizes, and stores financial documents in one secure platform.

5. Slack/Zoom

Facilitates team communication and real-time virtual meetings.

6. Trello/ClickUp

Manages tasks and workflows through visual boards and project tracking tools.

By using these tools, your assistant ensures your books are always accessible, secure, and up-to-date.

Why Choose TaskVirtual for Virtual Bookkeeping?

When it comes to finding a reliable, affordable, and skilled Virtual Bookkeeping Assistant, TaskVirtual stands out as a top choice, especially for businesses in the US and UK. Here’s why:

1. Expert Consultation on AI-Efficient Bookkeeping

TaskVirtual’s onboarding process begins with a free consultation, helping you identify the right balance of human skill and automation to streamline your books.

2. Affordable Pricing for Every Stage of Business

With flexible plans starting from $3.12/hour to $14.99/hour, TaskVirtual fits every budget—whether you’re a solo entrepreneur or an established SME.

3. Proven Satisfaction

TaskVirtual has earned 364+ positive reviews across platforms and maintains an impressive 4.7-star rating, making it one of the most trusted names in virtual assistant services.

4. Industry-Focused Bookkeepers

Whether you’re in e-commerce, real estate, consulting, or health services, TaskVirtual provides VAs trained in your vertical. That means fewer errors and faster onboarding.

If you’re looking to cut financial clutter, reduce costs, and gain real-time control over your books, TaskVirtual offers the perfect solution tailored to your needs.

Final Thoughts

In the digital age, a Virtual Bookkeeping Assistant isn’t just a support role—it’s a strategic advantage. By combining cloud technology, accounting expertise, and flexible work models, virtual assistants help US and UK businesses save money, operate efficiently, and scale without chaos.

Whether you’re just getting started or have an established business with complex financial operations, hiring a virtual bookkeeping assistant might just be the smartest decision you make in 2025.

Need help getting started? Consider TaskVirtual for a trusted, affordable, and results-driven bookkeeping solution tailored to your industry.