Outsource Invoice Processing Services: Streamline Your Financial Operations

Outsource Invoice Processing Services help businesses manage invoicing more efficiently, reduce errors, and save time by delegating accounts payable tasks to specialised providers. By combining expert teams with automation, companies improve cash flow, compliance, and operational efficiency.

What Are Outsource Invoice Processing Services?

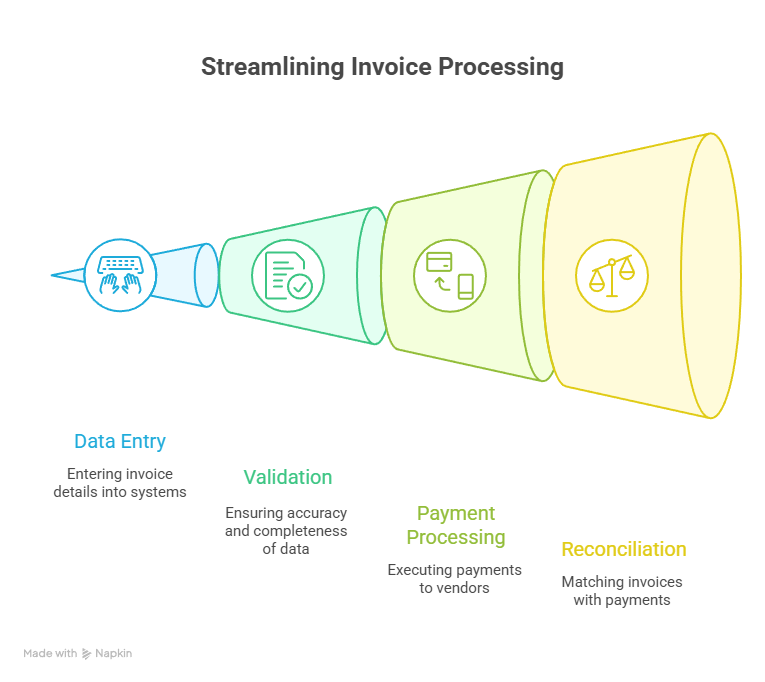

Managing invoices in-house can be time-consuming, error-prone, and costly. Outsource Invoice Processing Services solve this by delegating invoice-related tasks—such as data entry, validation, payment processing, and reconciliation—to external experts.

Unlike traditional processing, outsourcing streamlines workflows, leverages technology, and ensures businesses remain focused on core activities while financial operations stay compliant and efficient.

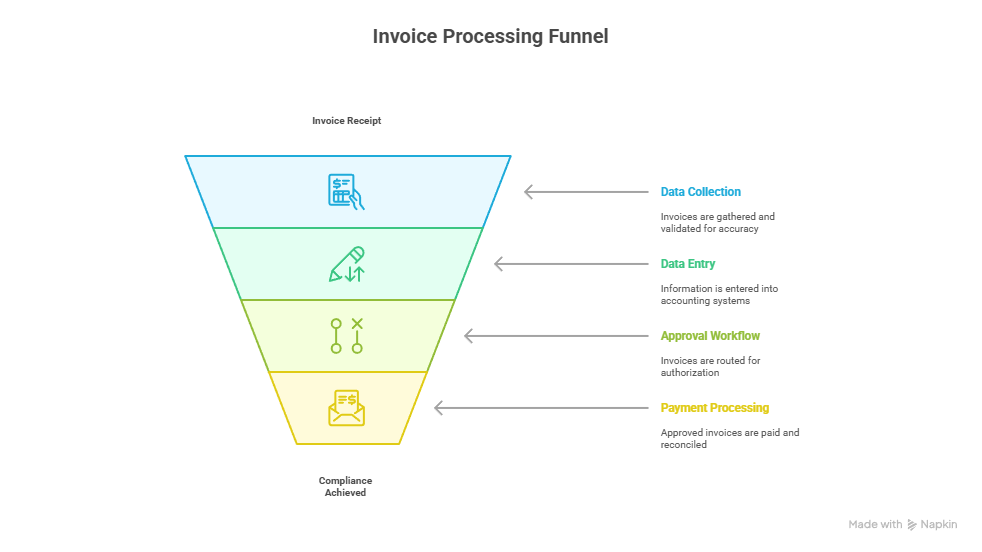

How Do Outsource Invoice Processing Services Work?

These services cover the full invoice lifecycle—from receipt to payment. Providers use automation and trained teams to reduce manual effort and speed up approvals.

1. Invoice Data Collection and Validation:

Providers gather invoices from multiple sources and confirm accuracy.

2. Data Entry and Processing:

Information is entered into accounting or ERP systems with precision.

3. Approval Workflow Management:

Invoices are routed to stakeholders for authorization.

4. Payment Processing and Reconciliation:

Approved invoices are paid and matched with purchase orders for compliance.

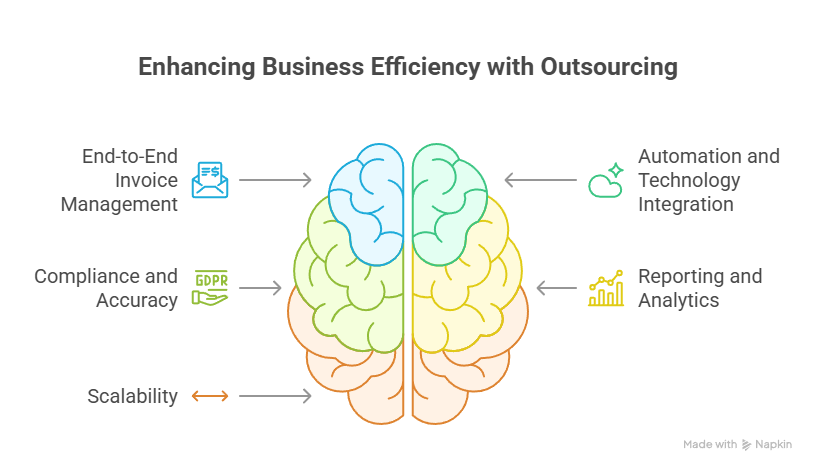

Key Features of Outsource Invoice Processing Services

Outsourcing brings advanced features that streamline invoice handling and enhance decision-making. One of the most important is end-to-end invoice management, where the entire lifecycle—from receipt to payment—is handled with accuracy and reduced manual effort. In addition, providers use automation and technology integration such as AI-driven tools and cloud platforms, which accelerate processing times while improving data accuracy. These capabilities ensure that businesses save time and reduce the risk of human error.

Another core strength is the focus on compliance and accuracy, with invoices validated against company policies and regulations to minimise risks. Outsourcing also delivers reporting and analytics, giving businesses access to detailed insights on invoice status, vendor performance, and cash flow trends. Finally, scalability makes outsourced services flexible enough to handle fluctuating invoice volumes, whether for small businesses or large enterprises, ensuring consistent performance regardless of demand.

Benefits of Using Outsourced Invoice Processing Services

Delegating invoice processing provides tangible advantages that extend beyond cost savings.

1. Efficiency:

By outsourcing, businesses free their teams from repetitive manual tasks, allowing them to focus on more strategic and value-driven activities.

2. Cost Savings:

Outsourcing reduces infrastructure and staffing expenses, making financial operations more affordable and resource-efficient.

3. Reduced Errors:

With automation and trained staff handling invoice workflows, the likelihood of mistakes is significantly minimized.

4. Faster Payments:

Streamlined processes and timely approvals lead to quicker payments, strengthening vendor relationships and unlocking potential discounts.

5. Visibility and Control:

Outsourcing provides real-time reporting and analytics, giving businesses the insights needed for smarter financial decision-making.

Outsource Invoice Processing Services vs Competitors: How Does It Compare?

Not all solutions are equal. Outsourcing stands out when compared with in-house teams and generic BPO providers.

Outsourced providers offer complete, end-to-end invoice management. In-house processing often struggles with limited resources, while BPOs only sometimes cover the full cycle. Automation is fully integrated in outsourcing but largely manual in-house and inconsistent with BPOs.

When it comes to compliance, outsourcing maintains higher accuracy by aligning with policies and standards. Cost efficiency is another major benefit—outsourcing avoids heavy staffing costs and remains scalable, whereas in-house systems are limited and BPOs vary depending on capability.

How to Use Outsource Invoice Processing Services

Implementing outsourced services is straightforward but requires structured onboarding.

1. Select a Reliable Provider:

Choose a provider with proven expertise, strong processes, and positive client feedback.

Provide access to systems, invoices, and company policies to enable accurate processing.

3. Onboarding and Setup:

Configure workflows, integrate systems, and align processes with business requirements.

4. Begin Processing:

Invoices are received, validated, and processed efficiently by the provider.

5. Monitor Reports:

Regularly review reports and analytics to maintain transparency and control.

Limitations of Outsource Invoice Processing Services

While highly effective, outsourcing is not without challenges.

-

Initial Setup Time: Integrating outsourced services with existing systems may take time, especially in complex organisations.

-

Provider Dependence: The quality of results depends heavily on the expertise and reliability of the outsourcing partner.

-

Data Security: Sensitive financial information is shared externally, making strong data protection measures essential.

TaskVirtual: Your Partner in Financial Operations Support

While outsourcing invoice processing is a strong step toward efficiency, many businesses need broader support to keep financial operations running smoothly. This is where TaskVirtual adds value—providing skilled invoice processing services that can handle invoice tasks alongside other finance-related responsibilities, giving businesses an affordable, flexible solution.

1. Expert Support for Invoice Management

TaskVirtual VAs can manage invoice entries, validations, and reconciliations, ensuring accuracy across financial records. They also coordinate with providers and teams to streamline the approval process.

2. Affordable, Scalable Virtual Assistance

With pricing starting as low as $3.12/hour and scaling up to $14.99/hour, TaskVirtual makes financial process support cost-effective for startups, SMEs, and large enterprises alike.

3. Process Organization and Workflow Support

From invoice tracking to payment scheduling, TaskVirtual ensures businesses stay organised and deadlines are met, reducing the risk of late fees or vendor dissatisfaction.

4. Ongoing Financial Optimization

Beyond invoices, TaskVirtual VAs assist with expense tracking, vendor communication, and reporting, helping businesses maintain clarity and control over finances.

5. Trusted by Businesses Worldwide

Backed by strong client feedback and a global presence, TaskVirtual has become a reliable partner for businesses seeking structured, affordable, and efficient support.

Final Thoughts on Outsourced Invoice Processing Services

Outsource Invoice Processing Services remain one of the most effective ways to improve efficiency, accuracy, and cost savings in financial operations. With the added flexibility of TaskVirtual’s virtual assistant support, businesses gain not just reliable invoice management but also comprehensive assistance to strengthen overall financial workflows.

Investing in these solutions ensures compliance, scalability, and operational excellence—making them a smart choice for businesses of every size.

FAQ: Outsource Invoice Processing Services

Q1. What are Outsource Invoice Processing Services?

A1. They manage the full invoice lifecycle, from entry to payment reconciliation.

Q2. Can small businesses benefit?

A2. Yes, services scale to suit any business size.

Q3. Do they use automation tools?

A3. Most providers employ AI and cloud systems for speed and accuracy.

Q4. How secure is my financial data?

A4. Reputable providers use encryption and strict access control.

Q5. Is outsourcing more cost-effective than in-house?

A5. Yes, it reduces staff, infrastructure, and training costs.