How to Use a Virtual Assistant to Improve Financial Forecasting

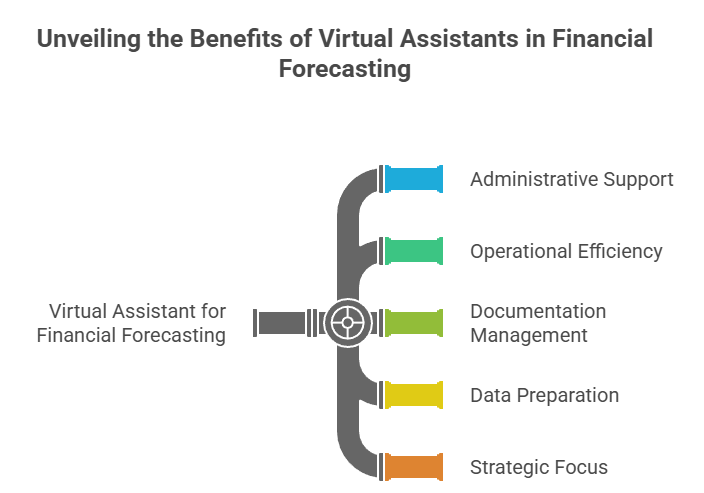

Using a Virtual Assistant in financial forecasting helps businesses streamline information management, reduce manual workload, and improve data accuracy across reporting processes. Instead of replacing financial analysts, a VA strengthens the foundation of financial planning by supporting data organization, documentation, and operational coordination. When structured properly, this partnership results in more reliable projections and better-informed financial decisions.

A Virtual Assistant enhances financial forecasting by assisting with data collection, spreadsheet management, expense tracking, reporting support, trend monitoring, and research tasks. While a VA does not replace financial analysts, they improve organization, reduce errors, and create efficiencies that support more accurate and timely financial forecasts.

What Does It Mean to Use a Virtual Assistant for Financial Forecasting?

Using a virtual assistant for financial forecasting means assigning structured support tasks that help finance teams prepare accurate projections with cleaner, better-organized data, allowing more time for high-value analysis rather than manual work. Research shows that automation and virtual assistant support can reduce manual administrative work by up to 40%, freeing finance teams to focus on interpretation, trend insights, and strategic decision-making. This approach creates an organized workflow where data preparation and financial insight work together effectively, improving both efficiency and accuracy in forecasting tasks.

A VA assists by managing recurring reporting inputs, keeping financial records updated, and consolidating operational information needed for forecasting models. They help gather expense and revenue data, maintain spreadsheets, document financial details, and research supporting trends that influence projections. By removing repetitive manual workload, the forecasting process becomes faster, more consistent, and easier to update across cycles.

How a Virtual Assistant Helps Improve Financial Forecasting

This section explains how a VA strengthens the financial forecasting workflow by improving organization, consistency, and operational clarity. With structured support activities assigned to a VA, businesses can maintain cleaner historical records, more accurate financial inputs, and better-prepared reporting materials for analysts and decision-makers. The result is a more dependable forecasting process supported by disciplined data management.

1. Organizing Financial Data and Reports

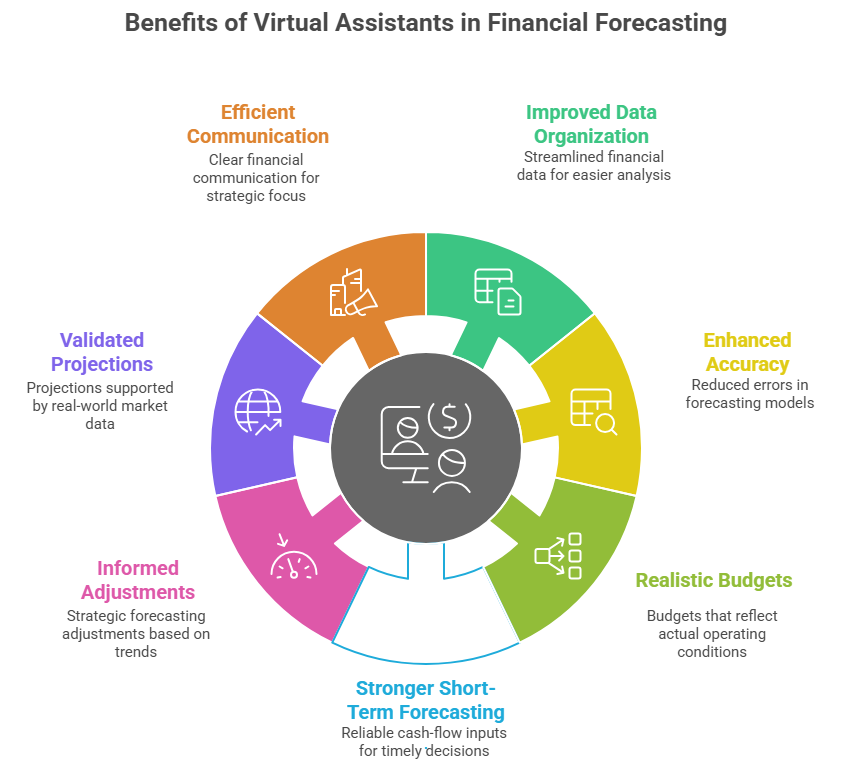

A VA helps organize revenue records, expense logs, sales figures, and operating cost data into structured formats that support accurate forecasting. By consolidating financial information into standardized reports, they reduce inconsistencies and make historical data easier to analyze. This organization improves visibility across financial periods and strengthens the quality of forecasting inputs.

2. Managing Spreadsheets and Forecast Templates

Virtual assistants maintain forecasting templates, update recurring data fields, and ensure that spreadsheet structures remain consistent across reporting cycles, helping streamline repetitive tasks that otherwise consume significant time. Statistics show that companies using AI-driven tools can reduce time spent on manual spreadsheet work by up to 60%, which directly improves efficiency and data accuracy in financial processes. This efficiency helps them review missing or incorrect entries, prepare historical comparison tables, and keep financial documents current for analyst review, reducing manual workload for finance professionals and minimizing calculation errors in forecasting models.

3. Expense Tracking and Categorization

A VA tracks ongoing expenses, organizes receipts, and categorizes cost entries to maintain accurate financial records. Consistent expense documentation helps businesses identify cost patterns and understand how spending trends affect future projections. With well-maintained expense data, budgets become more realistic and financial forecasts reflect actual operating conditions.

4. Assisting with Cash Flow Monitoring

Virtual assistants support cash-flow tracking by monitoring incoming payments, recurring expenses, vendor invoices, and outstanding balances. They help maintain up-to-date records that reflect near-term liquidity conditions and operational financial cycles. Reliable cash-flow inputs provide stronger short-term forecasting and support timely financial-planning decisions.

5. Supporting Variance and Trend Analysis

A VA prepares month-to-month comparisons, year-over-year summaries, and variance reports that show differences between forecasts and actual financial results. These structured summaries help analysts identify performance shifts, emerging patterns, and operational risks across financial periods. With clear trend documentation, forecasting adjustments become more informed and strategic.

6. Conducting Industry and Market Research

Virtual assistants gather external reference data such as pricing shifts, market benchmarks, economic trends, and sector performance indicators relevant to forecasting assumptions. This supporting research helps finance teams validate projections using real-world market context and environmental factors. Research-based insights create stronger justification for forward-looking financial expectations.

7. Preparing Management Dashboards and Summaries

A VA compiles reporting dashboards, visual summaries, and key performance snapshots that support financial review meetings and leadership reporting. Organized presentation materials help decision-makers clearly interpret financial direction and evaluate planning scenarios. With structured reporting support, financial communication becomes more efficient and strategically focused.

Key Benefits of Using a Virtual Assistant for Financial Forecasting

Introducing a VA into the forecasting workflow strengthens operational discipline, improves reporting quality, and reduces manual effort across financial preparation tasks. The business gains efficiencies that support more accurate forecasts and faster planning cycles while maintaining proper oversight by finance professionals. These benefits contribute to better-informed financial decisions and stronger organizational performance.

1. Improved Accuracy

Well-organized records, consistent data structures, and carefully maintained documentation reduce the likelihood of forecasting errors. By supporting disciplined data preparation, a VA helps ensure that financial inputs remain reliable and aligned across reporting periods. This structured foundation improves the accuracy and credibility of financial projections.

2. Significant Time Savings

Financial professionals spend less time on repetitive administrative preparation and more time on analysis, strategic interpretation, and decision-making. Delegating operational tasks to a VA shortens reporting cycles and accelerates the forecasting process. The organization benefits from faster turnaround times without sacrificing quality.

3. Better Data Consistency

Standardized financial formats, naming conventions, and structured templates create uniformity across financial records and reports, helping teams reduce errors and streamline reporting processes. According to research, 59% of businesses take at least six business days to close their books each period, and standardized processes can shorten reporting cycles while improving accuracy and consistency. This consistency helps a VA maintain continuity in documentation, simplifies comparative review and ongoing model updates, and strengthens long-term forecasting reliability and organizational financial discipline.

4. Cost-Effective Support

Hiring a VA provides scalable financial support at a lower operational cost compared to expanding in-house finance staffing. Businesses gain assistance where workload is administrative rather than analytical, allowing analysts to focus on higher-value responsibilities. This creates a balanced cost-to-impact advantage within financial operations.

5. Stronger Decision-Making

When financial data is well-organized and reporting quality is high, leaders gain clearer visibility into financial direction and performance trends. Better information leads to more confident planning, risk assessment, and resource allocation decisions. The combined effect strengthens financial strategy and organizational resilience.

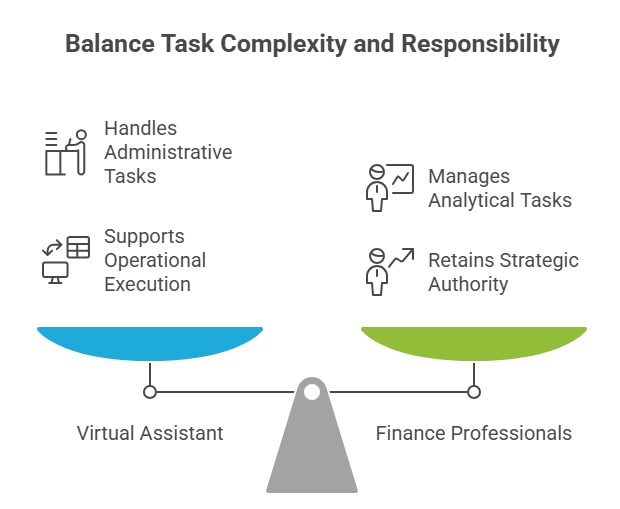

Tasks You Can Safely Delegate vs. Keep In-House

Delegating financial support activities to a VA requires clarity about which responsibilities are operational and which require professional financial expertise. Tasks assigned to a VA should remain administrative, structured, and process-focused, while analytical or regulatory decisions stay with qualified finance personnel. This division ensures accuracy, compliance, and accountability across financial operations.

1. Tasks Suitable for a Virtual Assistant

A VA can handle data entry, spreadsheet updates, expense tracking, report formatting, document organization, and recurring financial summaries. These activities improve efficiency, maintain structured records, and support the forecasting process without altering financial judgment or decision outcomes. Their role strengthens operational execution while remaining within appropriate responsibility boundaries.

2. Tasks That Should Stay with Finance Professionals

Financial analysts and senior finance leaders should retain responsibility for final analysis, forecasting model assumptions, strategic planning decisions, compliance reviews, taxation oversight, and audit-related activities. These areas require professional expertise, regulatory awareness, and fiduciary accountability that should not be delegated to a VA. The VA serves as structured support, not a replacement for financial authority.

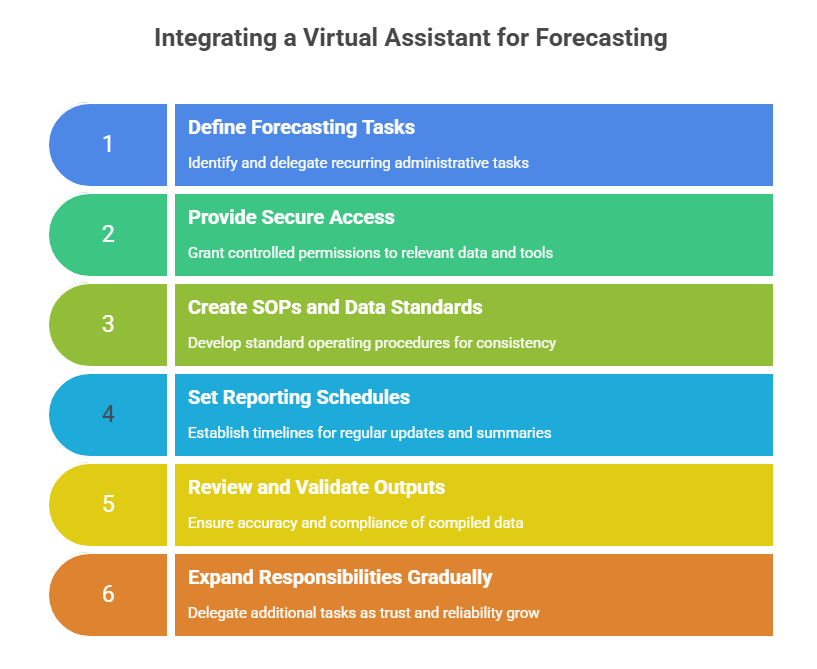

How to Work with a Virtual Assistant for Forecasting (Step-by-Step)

To achieve the best results, businesses should establish structured workflows, secure data processes, and clear task expectations when integrating a VA into forecasting activities. Effective collaboration depends on documented procedures, access controls, review checkpoints, and progressive responsibility expansion. This disciplined approach ensures accuracy, trust, and continuous improvement over time.

Step 1: Define Forecasting Tasks to Delegate

Identify recurring administrative activities such as data consolidation, reporting preparation, expense logging, or document organization that support the forecasting process. Clarify which tasks require analyst review versus operational execution. This structured task framework establishes clear responsibility boundaries from the beginning.

Step 2: Provide Secure Access and Tools

Use controlled permissions within accounting platforms, spreadsheets, or shared finance folders to ensure safe, compliant data handling. Access should be limited to relevant files and monitored through role-based security controls. This approach protects sensitive financial information while enabling efficient collaboration.

Step 3: Create SOPs and Data Standards

Develop standard operating procedures covering naming conventions, data entry rules, update frequency, approvals, and reporting structures. Clear documentation ensures tasks are performed consistently and reduces ambiguity across forecasting cycles. Standardization supports reliability and process continuity.

Step 4: Set Reporting Schedules

Establish weekly, monthly, or quarterly reporting timelines that define when updates, summaries, or reconciliations should be completed. Predictable schedules support workflow efficiency and ensure information remains current for forecasting analysis. This cadence keeps financial preparation aligned with business-planning needs.

Step 5: Review and Validate Outputs

Finance leaders should review compiled data, summaries, and reports before they are integrated into forecasting models or executive presentations. Oversight ensures accuracy, verifies assumptions, and confirms that inputs align with financial policy expectations. This validation step maintains accountability across all outputs.

Step 6: Expand Responsibilities Gradually

As accuracy, discipline, and reliability are demonstrated, additional administrative or documentation-based responsibilities may be delegated over time. Gradual expansion supports trust development while maintaining structured oversight and performance continuity. This measured approach builds a strong working partnership.

Limitations to Keep in Mind

While a VA significantly enhances efficiency, they should not independently make financial decisions or modify analytical assumptions. Sensitive financial information requires strict security controls, role-based permissions, and continuous monitoring. Complex modeling, regulatory interpretation, and financial accountability remain under the authority of qualified finance professionals.

TaskVirtual: Your Partner in Financial Forecasting Support Services

Managing financial records, reporting workflows, and forecasting preparation tasks can become time-consuming for growing businesses. From consolidating expense data to maintaining spreadsheet models and preparing management summaries, the administrative side of financial forecasting often requires ongoing attention and structure. TaskVirtual provides expert virtual assistant services to improve financial forecasting, reporting support, and operational data management to strengthen forecasting accuracy.

1. Expert Assistance in Financial Data Preparation

TaskVirtual’s trained virtual assistants support real estate professionals with lead follow-up, CRM updates, scheduling, listing coordination, and transaction-related tasks. They work within your systems and processes to ensure no opportunity is missed and daily operations run smoothly.

2. Affordable and Scalable Support Plans

Hiring in-house staff can be costly, but TaskVirtual offers a cost-effective alternative. Pricing plans range from $3.12/hour to $14.99/hour, making professional VA support accessible to solo agents, teams, and brokerages at every growth stage.

3. Comprehensive Forecasting Support Solutions

From spreadsheet maintenance and variance reporting assistance to cash-flow tracking and historical data consolidation, TaskVirtual delivers end-to-end administrative support for financial forecasting workflows. Their capabilities adapt to recurring reporting cycles, enabling businesses to maintain consistency, accuracy, and organization across financial periods.

4. Continuous Coordination and Quality Oversight

TaskVirtual’s approach goes beyond basic task execution by ensuring ongoing monitoring, communication, and quality assurance across all assigned responsibilities. Their proactive coordination helps maintain timely updates, structured documentation, and dependable data workflows—supporting smoother forecasting operations and leadership reporting processes.

5. Proven Credibility and Client Satisfaction

With 364 positive reviews and a 4.7-star rating on trusted VA platforms, TaskVirtual is recognized globally as a dependable virtual assistant provider. Real estate professionals rely on their expertise to save time, improve efficiency, and scale with confidence.

Final Answer: How to Use a Virtual Assistant to Improve Financial Forecasting

A Virtual Assistant strengthens financial forecasting by supporting data preparation, record organization, expense tracking, research, reporting coordination, and operational documentation. This structured support leads to cleaner information, better workflow efficiency, and more reliable forecasting inputs, enabling finance teams to focus on analysis, insights, and strategic decision-making. The strongest results occur when VA support is combined with financial expertise, disciplined oversight, and standardized forecasting processes.

FAQ: Using a Virtual Assistant for Financial Forecasting

1. Can a virtual assistant create financial forecasts independently?

VA assists with data preparation and reporting support, while financial analysts and leaders are responsible for final projections and strategic interpretation.

Yes, provided that secure systems, confidentiality agreements, role-based access controls, and monitored permissions are used to protect sensitive financial information.

3. Can a VA help with budgeting and management reports?

Yes. They can organize financial information, prepare draft summaries, and maintain reporting documentation, while final review and approval must remain with finance professionals.

4. Is hiring a virtual assistant cost-effective for finance support?

Yes. A VA reduces administrative workload, improves process efficiency, and supports financial operations at a lower cost than expanding internal staffing.

5. Can small businesses benefit from using a VA in forecasting?

Absolutely. Small businesses gain stronger financial organization, improved record accuracy, and better-prepared forecasting data without increasing full-time staffing costs.