Financial Report Analysis Service: Make Smarter Business Decisions with Expert Financial Insights

A Financial Report Analysis Service helps businesses interpret financial statements—including balance sheets, income statements, cash flow reports, and KPIs—to understand performance, identify risks, and make informed strategic decisions. These services turn raw financial data into clear, actionable insights that support growth, profitability, and long-term stability. By transforming complex financial numbers into meaningful direction, organizations can optimize operations and gain a competitive advantage.

What Is a Financial Report Analysis Service?

A Financial Report Analysis Service is a professional solution designed to review, interpret, and clearly explain a company’s financial information. Instead of simply presenting numbers, it translates data into insights that help business leaders make smart and informed decisions. This service is valuable for companies of every size — from startups to corporations — seeking to strengthen financial clarity, improve performance, and reduce uncertainty.

Financial experts conducting the analysis look deeply into profitability, liquidity, efficiency, and cash-flow health to evaluate the true condition of a business. They identify what strategies are working, what areas are underperforming, and where immediate corrective action could make a measurable difference. According to recent research, nearly 63% of companies report using financial or data analytics tools to improve efficiency and productivity. Ultimately, the service provides a roadmap to financial improvement and long-term stability.

How Does a Financial Report Analysis Service Work?

Before diving into the steps, it’s important to understand how the process unfolds and what makes it impactful. The analysis follows a structured method that ensures every essential detail of your financial performance is carefully examined. Each step contributes to building a full picture of your financial health and identifying opportunities for strategic improvement.

1. Collect and Review Financial Statements

The first step involves gathering your financial documents, including key statements like the balance sheet, income statement, and cash flow statement. During this phase, analysts review the structure, accuracy, and completeness of your records to establish a baseline understanding of your financial operations. This ensures that the analysis begins with reliable and verified data, which is critical for delivering meaningful results.

2. Identify Key Metrics and Trends

Once the financial statements are available, analysts start to observe patterns in revenue, expenses, assets, liabilities, and cash movement. They examine how financial elements change over time, helping identify growth or decline trends that influence future planning. This reveals the financial behaviors that shape overall business performance.

3. Perform In-Depth Ratio Analysis

Ratio analysis is performed to measure financial health using indicators related to liquidity, profitability, solvency, and operational efficiency. Analysts use these metrics to determine how effectively a business manages its resources and obligations. These ratios provide a clear way to compare current performance with internal goals and industry standards.

4. Compare Performance with Industry Benchmarks

Benchmarking involves comparing your company’s performance with competitors and industry averages. This process identifies whether your business is leading the market, keeping pace, or falling behind. These insights help prioritize decisions for growth and strategic repositioning.

5. Highlight Risks and Problem Areas

Analysts evaluate potential financial risks, identify early warning signs, and reveal issues that may threaten future results. They analyze areas such as declining revenue, high expenses, rising debt, and shrinking cash reserves. Recognizing problems early enables proactive correction before they escalate.

6. Deliver a Comprehensive Report

After analysis, you receive a structured and easy-to-understand financial report that explains findings clearly with visuals like charts and performance graphs. The report summarizes key strengths, weaknesses, and improvement opportunities. It becomes a practical guide for strategic action.

7. Strategic Consultation (Optional)

Some services provide personalized consultation to walk through results and recommended strategies. This includes discussing best-fit solutions and business priorities. These discussions give decision-makers confidence and clarity in executing improvements.

Key Features of Financial Report Analysis Services

Comprehensive analysis services provide a set of powerful features designed to support meaningful financial decisions. Each feature contributes essential information that helps a business operate more intelligently. Together, they create a detailed understanding of financial reality and pathways to improved performance.

1. Detailed Financial Statement Review

Experts review the balance sheet, income statement, and cash flow report in detail to evaluate structural financial health. They assess asset strength, liability levels, profitability trends, and liquidity position. This creates a foundational understanding of your organization’s financial status.

2. Ratio and KPI Analysis

Key Performance Indicators and financial ratios measure the true efficiency and profitability of your business. Analysts study metrics such as return on investment, profit margins, debt-to-equity, and working capital to understand financial health from multiple angles. These metrics reveal internal performance quality and operational capability, and their value is reflected in a 2020 global survey on the balanced scorecard (a KPI-based performance framework), where 88% of respondents reported using it for strategy implementation and 63% for operational management, underlining how central structured KPIs are to modern performance management.

3. Cash Flow Evaluation

Analysts carefully examine cash inflows and outflows to understand liquidity strength and spending patterns. This identifies whether cash is being used effectively and whether shortages are likely. Proper cash flow knowledge prevents operational disruption.

4. Forecasting and Projections

Using historical results and market expectations, analysts predict future financial scenarios. Forecasts enable informed planning, budgeting, and investment decisions. They help businesses prepare for growth challenges and opportunities.

5. Trend and Variance Analysis

Performance is compared across monthly, quarterly, or yearly periods to understand direction and momentum. Analysts identify reasons behind increases or decreases in profitability and spending. This analysis supports smarter long-term financial planning.

6. Competitor and Industry Benchmarking

Benchmarking compares your performance with market peers to highlight strengths and weaknesses. Analysts reveal gaps that could limit growth or opportunities where your business can excel. This provides valuable insight for competitive strategy.

7. Actionable Recommendations

Recommendations provide practical steps designed to reduce costs, increase profitability, and improve operational efficiency. They are based on real data and aligned with business goals. This transforms insights into results.

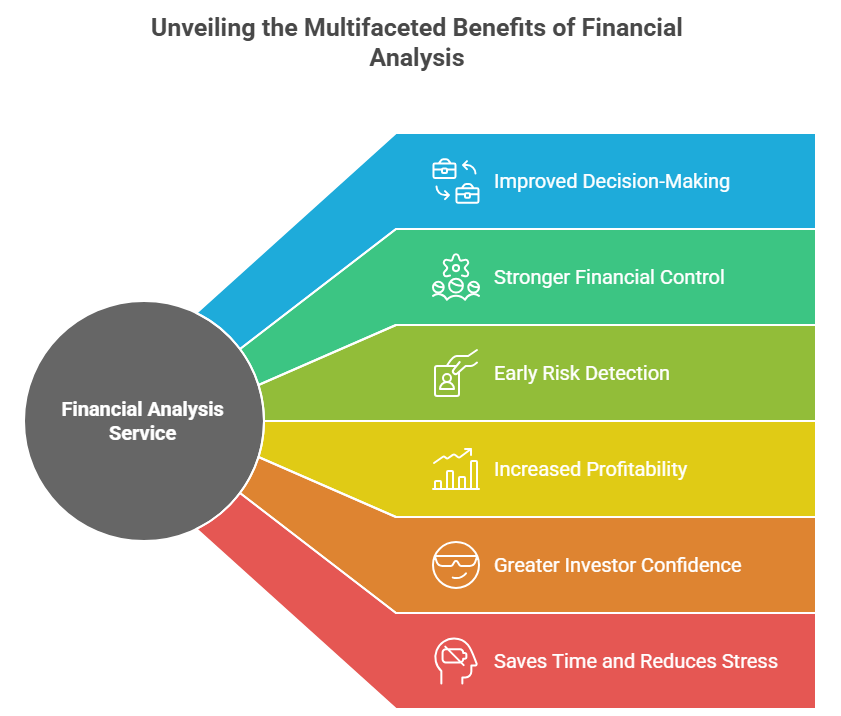

Benefits of Using a Financial Report Analysis Service

Professional financial analysis offers measurable advantages that impact every stage of business development. It not only helps companies understand numbers but also guides data-driven decision-making. These benefits help organizations grow with confidence and long-term direction.

1. Improved Decision-Making

Insightful analysis allows leaders to confidently decide where to invest, where to reduce spending, and how to restructure operations. Decisions become strategic rather than reactive, leading to stronger business outcomes. Better decision-making also empowers effective long-term planning.

2. Stronger Financial Control

By understanding financial performance in detail, businesses gain greater control over spending, resource allocation, and operational structure. This prevents overspending and waste, increasing stability and sustainability. Strong control ensures financial consistency and accuracy.

3. Early Risk Detection

Analysis identifies risks such as cash shortages, rising operating expenses, and debt pressure before they become major threats. Early detection helps businesses take corrective action in time, which is critical given that a U.S. Bank study found 82% of small businesses fail due to poor cash flow management or cash flow understanding. This underscores how proactive financial analysis safeguards financial resources and protects future profitability by addressing risks before they escalate.

4. Increased Profitability

Financial analysis highlights underperforming products, inefficient processes, and high-cost areas. Addressing these issues can significantly improve profit margins. Increased profitability fuels company growth and innovation.

5. Greater Investor Confidence

Clear financial reporting increases transparency and builds trust among lenders, investors, partners, and stakeholders. Investors are more likely to support businesses that understand and manage their financial performance well. Strong confidence leads to better funding opportunities.

6. Saves Time and Reduces Stress

Financial experts handle the complexity of data interpretation, saving business owners time and reducing mental load. This frees leaders to focus on operations and growth. Professional support eliminates confusion and frustration around financial analysis.

Financial Report Analysis Service vs In-House Analysis

|

Feature |

Outsourced Financial Analysis |

In-House Analysis |

|

Expertise |

Access to financial specialists |

Limited skill range |

|

Cost |

More affordable than full-time staff |

Requires salaries & tools |

|

Accuracy |

Objective review & higher accuracy |

May involve bias or errors |

|

Tools & Software |

Advanced analytics technology |

Limited resources |

|

Turnaround |

Faster and more efficient |

Time-consuming |

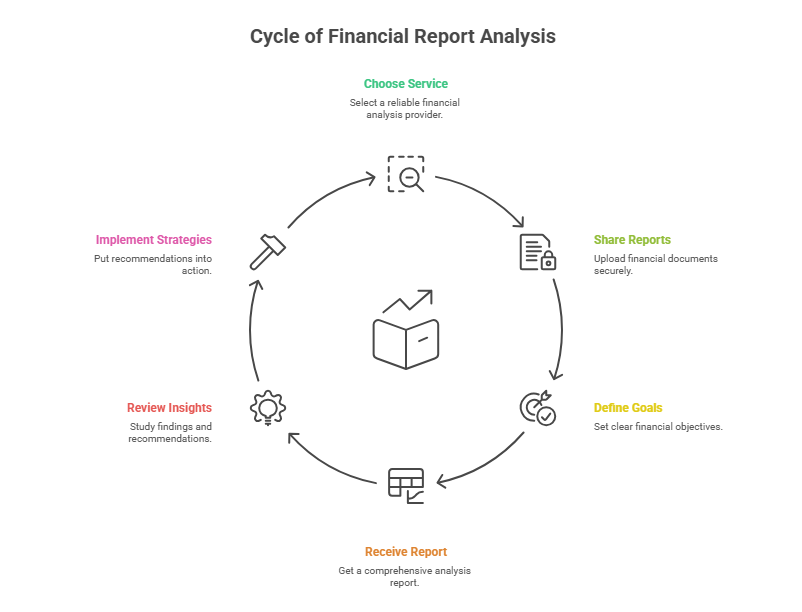

How to Use a Financial Report Analysis Service

Understanding how to work with a financial analysis provider ensures smooth collaboration and strong results. The process is simple for businesses of all sizes. Following these steps helps achieve clear outcomes aligned with business priorities.

Step 1: Choose a Professional Service

Select a provider with proven experience in finance, accounting, and business performance analysis. Review their background, tools, and client results. A strong provider ensures reliability and meaningful financial improvement.

Upload your balance sheet, income statement, cash flow statement, and supporting financial data through a secure platform. Clear documentation ensures accurate evaluation. The more complete your data, the better the insights.

Step 3: Define Goals

Communicate your objectives, such as improving profitability, reducing cost structure, raising investment, or understanding cash flow. Clear goals ensure the analysis focuses on priority areas. Well-defined targets lead to more valuable outcomes.

Step 4: Get Your Analysis Report

Receive a full, easy-to-read report outlining key insights and performance evaluation. This includes charts, ratio analysis, warnings, strengths, and opportunities. The report becomes a reference guide for operational planning.

Step 5: Review Insights & Recommendations

Study the findings and consider suggested strategies for improvement. Discuss implementation steps with financial advisors if available. Understanding the reasoning behind recommendations builds clarity.

Step 6: Implement Strategies

Put the recommendations into action across financial management, operations, sales, and budgeting. Track progress to measure results. Strong implementation leads to measurable financial growth.

Limitations of Financial Report Analysis Services

While extremely valuable, analysis services also have certain limitations businesses should understand. Knowing these limitations helps set realistic expectations. This ensures the best use of insights and tools.

1. Requires Accurate Data

If financial records are inaccurate or incomplete, analysis results may also be misleading. Reliable input is essential to produce reliable output. Good bookkeeping strengthens the effectiveness of analysis.

2. Not a Replacement for an Accountant

This service interprets financial performance; it does not manage ongoing bookkeeping or tax responsibilities. Accounting and financial analysis are separate processes. Both are necessary for healthy business management.

3. Results Depend on Clarity of Goals

The more specific the objectives, the more useful and targeted the analysis becomes. Clear direction ensures personalized insights. Vague goals may lead to general recommendations.

TaskVirtual: Your Partner in Financial Analysis Support Services

Managing, organizing, and analyzing financial reports can be demanding, especially for businesses without dedicated financial staff. From gathering financial documents to updating monthly reports and coordinating data across platforms, the process requires time, attention, and expert support. TaskVirtual provides skilled financial analysis virtual assistance for financial documentation management and administrative financial tasks, helping businesses streamline reporting and reduce operational pressure.

1. Expert Assistance for Financial Documentation and Review

TaskVirtual’s experienced virtual assistants help businesses manage financial records, organize historical reports, format financial documents, and support preparation for financial analysis. They assist in coordinating data, updating spreadsheets, tracking financial submissions, and preparing files for professional analysts or investors. Their support ensures accuracy, organization, and readiness for analysis without overwhelming internal teams.

2. Affordable and Flexible Pricing

Hiring full-time financial administrative staff can be costly, but TaskVirtual offers a budget-friendly alternative. With pricing plans starting from just $3.12/hour to $14.99/hour, businesses of all sizes can access skilled support without stretching budgets. This makes professional financial organization accessible to startups, growing companies, and expanding organizations.

3. Comprehensive Financial Operations Support

TaskVirtual offers adaptable services, helping with tasks including processing monthly financial updates, maintaining KPI dashboards, preparing spreadsheets, supporting investor reporting schedules, and coordinating document sharing. Whether you require occasional help or ongoing support, their services scale with business needs. This ensures seamless financial process management and productivity.

4. Ongoing Support and Quality Assurance

TaskVirtual goes beyond basic administrative work by providing consistent follow-up, reminders, task tracking, and communication assistance. Their proactive support ensures that financial records remain organized, deadlines are met on time, and reporting is stress-free. This reliability helps management teams stay focused on strategic financial decisions rather than paperwork.

5. Proven Track Record of Excellence

With 364 positive reviews and a 4.7-star rating across trusted global virtual assistant platforms, TaskVirtual is recognized as a reliable partner for business process support. Companies worldwide trust their expertise to simplify financial operations and improve administrative efficiency. Their long-standing client satisfaction reflects a commitment to professionalism and high-quality service.

Final Thoughts on Financial Report Analysis Services

A Financial Report Analysis Service is an essential resource for businesses seeking deeper financial understanding and improved decision-making. It provides clarity on performance, highlights risks, and uncovers growth opportunities that enhance business strength and competitiveness. Instead of making decisions blindly, leaders gain insight and control based on precise data.

Whether preparing for investors, scaling operations, or trying to improve profitability, expert analysis transforms raw financial information into strategic action. This service becomes a powerful tool for shaping financial stability, gaining efficiency, and ensuring long-term success. Businesses that invest in financial clarity position themselves to grow confidently and responsibly in any economic environment.

FAQ: Financial Report Analysis Service

1. What is a Financial Report Analysis Service?

It is a professional service that evaluates, interprets, and explains financial statements to provide business insights, recommendations, and strategic direction.

2. Can it help identify financial problems early?

Yes, it reveals risks such as cash shortages, overspending, rising debt, and declining margins before they evolve into serious issues.

3. Does this service help improve profitability?

Absolutely. It identifies inefficiencies, high-cost segments, and new revenue opportunities that enhance profitability.

4. Who needs financial report analysis?

Startups, small businesses, corporations, CFOs, investors, financial managers, and any organization seeking clarity and performance improvement.

5. Is it useful for investment decisions?

Yes. It helps evaluate financial strength and stability before making investment, lending, or expansion decisions.