Why a Virtual Assistant for Insurance Agency Support Pays Off

A Virtual Assistant for Insurance Agency is a remote professional who supports insurance agents and agencies with administrative, customer service, policy management, lead tracking, and documentation tasks. They help agencies reduce workload, improve client response times, and streamline operations without the cost of hiring full-time, in-house staff.

What Is a Virtual Assistant for an Insurance Agency?

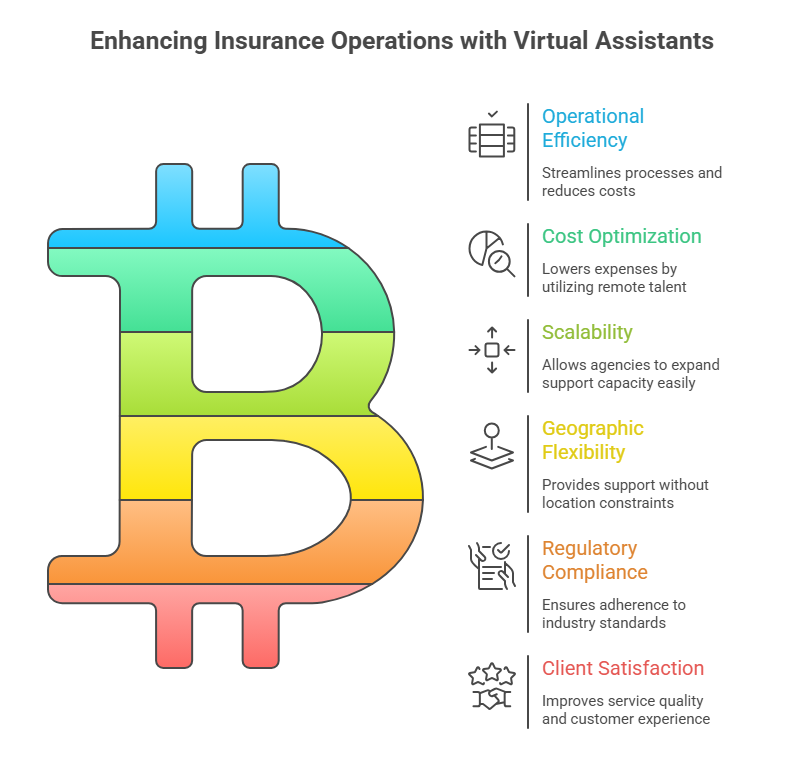

A virtual assistant supporting insurance operations is a remote professional trained to work within insurance-specific workflows, systems, and compliance-driven processes. Unlike a general assistant, an insurance virtual assistant understands policy lifecycles, client servicing protocols, documentation standards, CRM usage, and carrier communication structures. Industry studies indicate over 60% of insurers prioritize operational efficiency and cost optimization, reinforcing demand for remote insurance virtual assistant support while maintaining strict confidentiality requirements.

Depending on agency needs, they may operate as an insurance administrative virtual assistant, an insurance customer support virtual assistant, or a virtual assistant for insurance agents, enabling firms to scale support capacity without geographic limitations. Many agencies also seek an insurance virtual assistant USA or a US-based insurance virtual assistant when regulatory familiarity, language precision, and time-zone alignment are operational priorities.

What Does a Virtual Assistant for an Insurance Agency Do?

Insurance agencies operate within high-volume, process-intensive environments where responsiveness, accuracy, and documentation integrity directly affect revenue and client retention. Administrative overhead, repetitive servicing tasks, and constant follow-up requirements create operational friction that limits producer productivity. A structured support model using an insurance virtual assistant for data entry, client coordination, and policy servicing can stabilize workflows and improve service consistency.

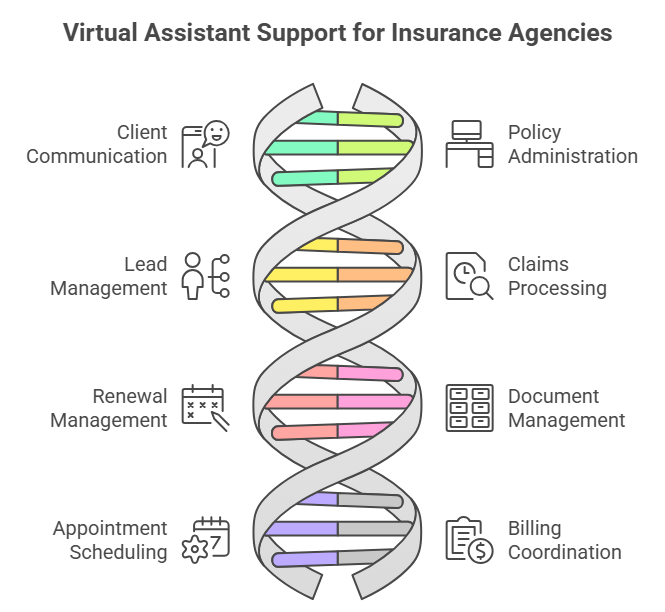

1. Client Communication and Customer Support

An insurance customer support virtual assistant manages inbound and outbound client interactions across email, chat, and phone channels, ensuring inquiries are acknowledged and routed efficiently. They provide non-licensed assistance such as appointment coordination, document requests, billing reminders, and status updates, maintaining continuity of communication. This structured response mechanism shortens turnaround times, improves client satisfaction metrics, and allows licensed personnel to focus on advisory and sales functions.

2. Policy Administration Support

A virtual assistant for policy management handles structured administrative tasks, including policy data entry, endorsement documentation, renewal updates, and system record maintenance. By functioning as an insurance administrative virtual assistant, they preserve data accuracy and reduce processing bottlenecks that commonly occur during peak renewal cycles. Industry findings show automation can cut error rates from roughly 7% to under 0.2%, highlighting the value of structured support. Reliable policy administration directly minimizes errors, reduces E&O exposure, and improves operational efficiency.

3. Lead Management and CRM Updates

An insurance virtual assistant for lead management supports prospect tracking, CRM updates, pipeline organization, and scheduled follow-up sequences. They maintain clean databases, update contact records, and coordinate appointments, reinforcing sales process discipline. Consistent lead handling improves conversion ratios and prevents revenue leakage caused by delayed or missed follow-ups.

4. Claims Processing Assistance

A virtual assistant for insurance claims provides procedural support by collecting documentation, updating claim logs, tracking correspondence, and coordinating communication between clients and adjusters. While they do not replace licensed claims professionals, they maintain administrative continuity across the claims lifecycle. This reduces processing delays and improves transparency for policyholders during critical service interactions.

5. Renewal and Follow-Up Management

Renewal workflows are stabilized when a dedicated insurance virtual assistant tracks policy expiration dates, initiates reminder sequences, and coordinates required documentation. They ensure clients receive timely notifications and assist with scheduling coverage reviews. Effective renewal management protects retention rates and sustains recurring revenue streams.

6. Document Management and Compliance Support

Insurance operations depend heavily on documentation precision, audit readiness, and record traceability. An insurance virtual assistant for data entry and file management maintains digital records, formats documents, and performs data verification tasks. Proper document control reduces compliance risks and supports regulatory alignment.

7. Appointment Scheduling and Calendar Management

A virtual assistant for insurance agents frequently manages consultation bookings, follow-up calls, internal meetings, and cross-team coordination. Structured scheduling ensures producers maintain predictable workloads and client interactions remain organized. Operational discipline at the calendar level directly improves productivity and client experience.

8. Billing and Payment Coordination

An assistant operating within insurance workflows may prepare invoices, track payments, update billing records, and perform outstanding balance follow-ups. These tasks reinforce cash-flow stability and reduce administrative strain on internal staff. Consistent billing coordination also strengthens financial controls within the agency.

Skills Required for a Virtual Assistant in an Insurance Agency

A qualified insurance virtual assistant typically demonstrates working knowledge of insurance terminology, policy structures, servicing cycles, and CRM platforms. Precision in written and verbal communication is essential, particularly when interacting with clients, carriers, and internal stakeholders. Attention to procedural detail is critical, as even minor administrative inaccuracies can propagate operational and compliance issues.

Equally important are data management discipline, document handling accuracy, and adherence to confidentiality protocols. A competent remote insurance virtual assistant understands secure information practices, workflow documentation standards, and system navigation requirements. Industry familiarity accelerates onboarding, reduces supervision overhead, and enhances overall effectiveness.

Benefits of Hiring a Virtual Assistant for an Insurance Agency

Insurance agencies face continuous pressure to balance service responsiveness, operational cost control, and revenue generation. Administrative workloads frequently divert licensed staff from high-value activities such as advising clients and closing policies. Leveraging insurance virtual assistant services addresses this imbalance by redistributing repetitive tasks.

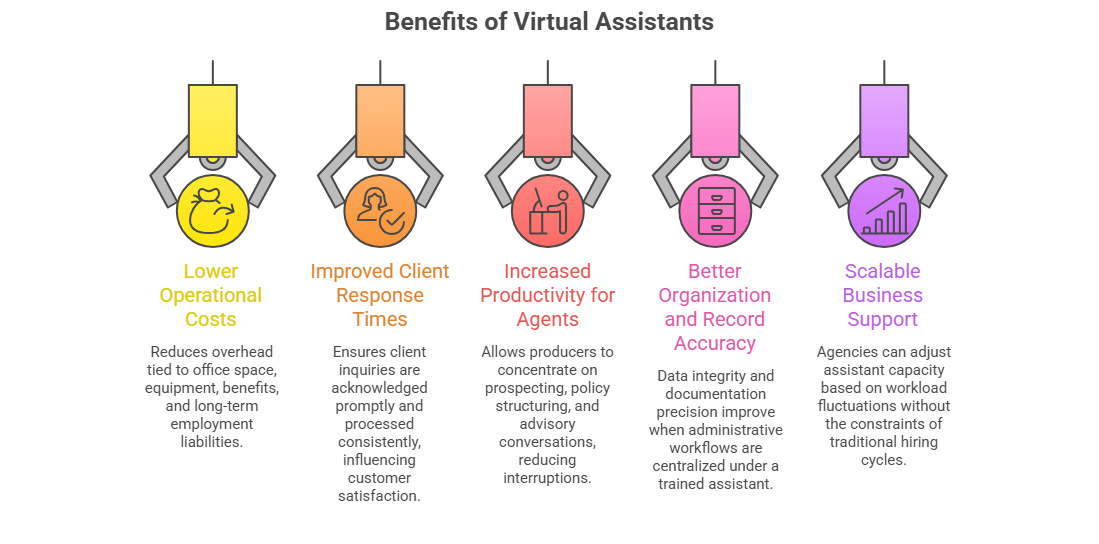

1. Lower Operational Costs

Choosing to hire an insurance virtual assistant significantly reduces overhead tied to office space, equipment, benefits, and long-term employment liabilities. An affordable insurance virtual assistant model enables agencies to allocate resources more strategically. Cost efficiency improves without compromising operational continuity.

2. Improved Client Response Times

A structured insurance customer support virtual assistant function ensures client inquiries are acknowledged promptly and processed consistently. With over 50% of consumers expecting a brand to respond within an hour, faster response cycles directly influence customer satisfaction and retention and strengthen brand perception.

3. Increased Productivity for Agents

Administrative delegation allows producers to concentrate on prospecting, policy structuring, and advisory conversations. A virtual assistant for independent insurance agents or brokers reduces interruptions caused by routine servicing tasks. Productivity gains translate into measurable revenue improvements.

4. Better Organization and Record Accuracy

Data integrity and documentation precision improve when administrative workflows are centralized under a trained assistant. An insurance virtual assistant for data entry ensures systems remain updated and audit-ready. Accurate records reduce errors and operational disruptions.

5. Scalable Business Support

Agencies can adjust assistant capacity based on workload fluctuations without the constraints of traditional hiring cycles. A dedicated insurance virtual assistant offers predictable, flexible support. Scalability becomes operationally straightforward.

Who Should Hire a Virtual Assistant for an Insurance Agency?

Administrative saturation and client servicing demands vary across agency types, growth stages, and business models. Support structures must adapt to maintain efficiency without inflating fixed costs. Virtual assistance is particularly effective where operational workload exceeds internal capacity.

1. Independent Insurance Agents

A virtual assistant for independent insurance agents stabilizes servicing workflows, manages documentation, and coordinates follow-ups, allowing agents to focus on client acquisition and advisory activities.

2. Small Insurance Agencies

Smaller firms benefit from affordable insurance virtual assistant arrangements that deliver enterprise-level administrative support without high payroll commitments.

3. Growing Insurance Firms

Rapidly expanding agencies use insurance virtual assistant services to scale operations, maintain response times, and preserve service quality during growth phases.

4. Insurance Brokers

A virtual assistant for insurance brokers supports prospect management, documentation flows, and communication tracking across multiple carriers and client accounts.

5. Agencies with High Client Volumes

High-transaction environments require a dedicated insurance virtual assistant to prevent bottlenecks, maintain records, and ensure consistent client interaction handling.

TaskVirtual: Specialized Virtual Assistance for Insurance Workflows

Insurance agencies require structured, reliable support capable of operating within compliance-sensitive environments, client servicing models, and documentation-heavy processes. Managing policies, claims coordination, CRM updates, and client communication simultaneously often creates operational strain that affects response times and internal productivity. TaskVirtual delivers insurance-focused virtual assistant solutions designed specifically to align with agency operations, sales processes, and administrative workloads.

1. Insurance Administration and Policy Support

TaskVirtual’s virtual assistants handle policy-related administrative functions, including data entry, documentation updates, renewal tracking, and record maintenance. Their workflow familiarity enables seamless coordination with agency management systems and CRM platforms. This ensures policy information remains accurate, organized, and operationally accessible.

2. Affordable and Flexible Pricing

Expanding internal teams typically involves significant financial commitments, infrastructure expenses, and long-term staffing constraints. TaskVirtual provides a cost-efficient alternative, with pricing plans starting from just $3.12/hour to $14.99/hour, allowing agencies to scale support without increasing fixed overhead. This pricing structure supports both small agencies and growing insurance businesses.

3. Claims and Client Communication Assistance

TaskVirtual assistants support claims workflows by maintaining communication logs, organizing documentation, and coordinating updates between stakeholders. They also manage routine client interactions, appointment scheduling, and follow-up communication. This improves client responsiveness while reducing administrative interruptions for licensed staff.

4. Lead Management and CRM Maintenance

Sales efficiency improves when lead tracking, database organization, and CRM updates are consistently maintained. TaskVirtual virtual assistants ensure prospect pipelines remain structured and follow-ups are executed on schedule. Organized data management directly contributes to improved conversion performance.

5. Proven Reliability and Client Satisfaction

TaskVirtual maintains a strong service reputation, supported by 364 positive reviews and a 4.7-star rating across recognized virtual assistant platforms. Agencies rely on consistent delivery standards, workflow accuracy, and communication reliability. This track record reflects operational dependability within professional service environments.

Final Answer: What Is a Virtual Assistant for an Insurance Agency?

An insurance-focused virtual assistant is a remote operational specialist who supports client communication, policy servicing, claims coordination, documentation control, CRM maintenance, scheduling, and billing workflows. Whether functioning as an insurance administrative virtual assistant, a virtual assistant for insurance companies, or a remote insurance virtual assistant, their primary objective is to absorb repetitive, process-driven tasks that constrain licensed staff productivity. Agencies that hire insurance virtual assistant support gain measurable advantages in cost efficiency, response consistency, workflow stability, and scalability.

This staffing model also improves organizational discipline by reinforcing data accuracy, compliance readiness, and structured client engagement. For agencies prioritizing regulatory familiarity and time-zone alignment, a US-based insurance virtual assistant or insurance virtual assistant USA can offer additional operational compatibility. Ultimately, virtual assistants enhance agency performance by enabling producers and advisors to concentrate on revenue-generating and client-facing responsibilities rather than administrative overhead.

FAQ: Virtual Assistant for Insurance Agency

1. Is hiring a virtual assistant for an insurance agency cost-effective?

Yes. It significantly reduces overhead expenses.

2. Can an insurance virtual assistant handle policy renewals?

Yes. Renewal tracking and reminders are common tasks.

3. Are virtual assistants secure for insurance businesses?

Yes, with proper confidentiality agreements and secure systems.

4. Do insurance virtual assistants need licenses?

No. They handle non-licensed administrative tasks only.

5. Can small agencies benefit from virtual assistants?

Yes. Small agencies often benefit the most.