How Virtual Assistants Strengthen Financial Accounting Analysis for Smarter Business Decisions

Financial Accounting Analysis: The Backbone of Business Performance

Financial accounting analysis is the core of effective business management. It converts raw financial data into insights that guide budgeting, forecasting, investment decisions, and long-term strategy. Without accurate analysis, businesses risk poor cash flow, inefficiencies, and missed growth opportunities.

The importance of financial analysis continues to grow. According to the Association of Certified Fraud Examiners, organizations lose an estimated 5% of annual revenue due to poor financial controls. Meanwhile, a Deloitte survey found that 49% of financial leaders consider data analysis critical for future competitiveness.

Because financial analysis demands accuracy, speed, and structured reporting, many companies now rely on virtual assistants trained in accounting support to streamline processes and improve financial visibility.

What Is Financial Accounting Analysis

Financial accounting analysis is the structured evaluation of a company’s financial statements — including the income statement, balance sheet, cash flow statement, and equity statement — to understand profitability, liquidity, performance trends, and risk exposure.

This analysis helps leaders answer key questions:

- Are revenues growing or stagnating?

- What is driving expenses?

- Is cash flow stable enough to sustain operations?

- Are assets being used efficiently?

- What financial risks could threaten the business?

According to PwC’s finance insights report, companies that leverage systematic financial analysis are 36% more likely to achieve sustained profitability.

Virtual assistants contribute to this process by preparing reports, cleaning data, tracking metrics, and assisting accountants with research and documentation.

How Financial Accounting Analysis Works

Financial accounting virtual assistants follow a structured, multi-step process to ensure accuracy and compliance. Virtual assistants support nearly every stage, helping businesses maintain smooth, efficient financial operations.

1. Gathering Financial Data

The process begins with collecting ledgers, bank statements, invoices, receipts, payroll reports, and prior financial statements. VAs help organize and categorize these records for easier analysis.

2. Verifying and Reconciling Data

Accuracy is essential. VAs assist accountants by reconciling bank statements, matching entries, and checking for discrepancies. This reduces the risk of errors in final reports.

3. Performing Ratio and Trend Analysis

Financial professionals use ratios (profitability, liquidity, solvency, efficiency) and year-over-year comparisons to identify trends. VAs prepare spreadsheets, charts, and summaries to support this analysis.

4. Interpreting and Reporting Results

Accountants interpret the numbers and prepare insights. VAs format reports, create dashboards, and structure presentations for stakeholders’ review.

5. Preparing for Audits and Compliance Reviews

VAs organize documents, maintain audit trails, and prepare compliance checklists — ensuring smoother internal or external audits.

Key Features of Financial Accounting Analysis

Financial accounting analysis includes several essential features that help companies monitor performance, maintain compliance, and make informed decisions.

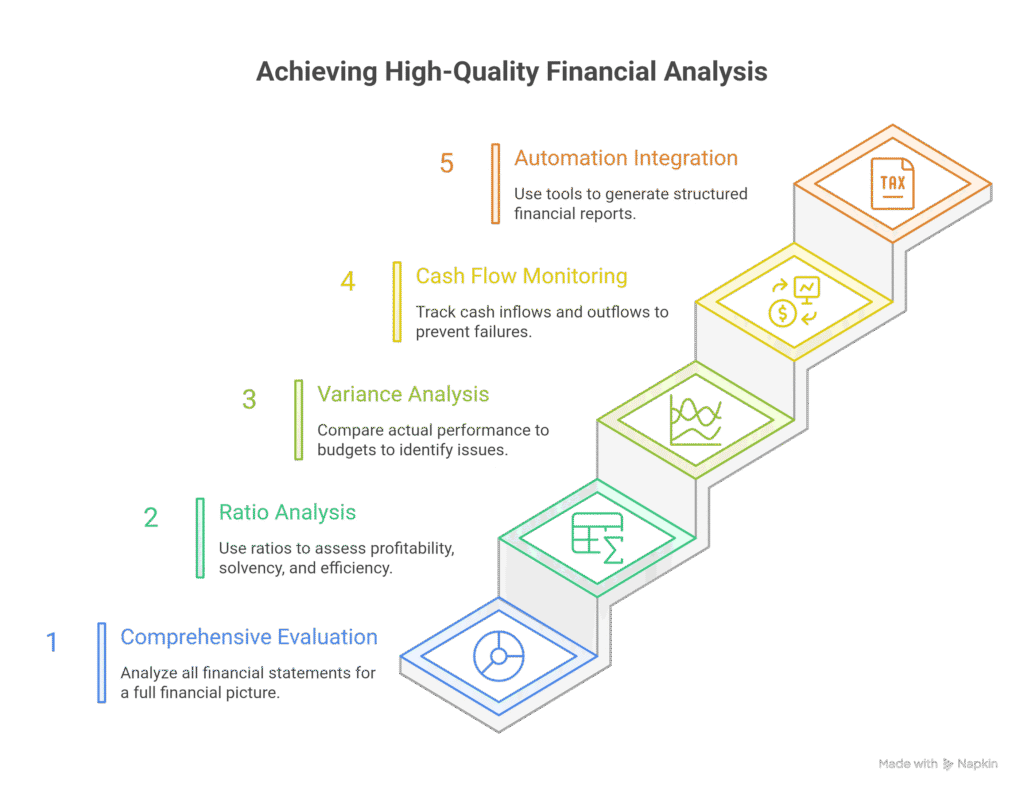

Below is an overview of the core components that define high-quality financial analysis.

1. Comprehensive Financial Statement Evaluation

Analysis covers income statements, balance sheets, cash flows, and equity statements to provide a full picture of financial health.

2. Ratio and Performance Analysis

Companies rely on ratios to evaluate profitability, solvency, liquidity, and operational efficiency. VAs assist by preparing detailed ratio worksheets.

3. Variance and Trend Analysis

By comparing actual performance to budgets or past years, businesses can identify problem areas early and take corrective action.

4. Cash Flow Monitoring and Forecasting

Since cash flow issues cause 82% of business failures (SCORE), consistent monitoring is essential. VAs help track inflows and outflows in real time.

5. Automation and Reporting Tools Integration

Excel, QuickBooks, Xero, Zoho Books, and BI tools are used to generate structured financial reports. VAs support setup, updates, and data maintenance.

Benefits of Financial Accounting Analysis

Financial accounting analysis offers multiple strategic benefits that help businesses manage growth, reduce risk, and make smarter decisions.

Below are the most significant advantages of using structured financial analysis.

1. Improved Profitability and Cost Control

By identifying expense drivers and inefficiencies, companies can improve margins and allocate resources better.

2. Better Cash Flow Stability

Accurate cash flow analysis prevents liquidity issues and ensures operational continuity.

3. Stronger Strategic Decision-Making

Businesses with well-structured financial insights are 23% more likely to hit their revenue goals (McKinsey).

4. Increased Investor and Stakeholder Confidence

Clear reporting enhances credibility with banks, investors, and board members.

5. Reduced Risk and Stronger Compliance

Structured analysis of financial data helps detect anomalies, fraud risks, and compliance issues early.

How to Implement Financial Accounting Analysis for Your Business

Successful implementation of financial accounting analysis requires systematic planning and consistent workflows.

Below is a step-by-step method businesses use to strengthen financial transparency.

1. Collect and Organize All Financial Records

VAs help categorize invoices, receipts, payroll data, and ledgers into a centralized system.

2. Set Up Analysis Templates and Reporting Tools

Financial models, dashboards, and Excel templates help standardize reporting across cycles.

3. Perform Routine Ratio and Trend Analysis

A fixed monthly or quarterly schedule ensures insights remain consistent and actionable.

4. Identify Risks and Financial Gaps

These gaps may involve declining liquidity, cost overruns, payment delays, or low profitability.

5. Create Data-Backed Action Plans

VAs help compile recommendations and prepare reports for internal meetings.

How Virtual Assistants Help in Financial Accounting Analysis

Virtual assistants play a critical role in financial accounting analysis by handling data-heavy, repetitive, and time-consuming tasks while supporting accountants and CFOs in creating accurate insights.

Here are the major ways VAs streamline financial operations.

1. Financial Data Entry and Organization

VAs input data accurately into accounting systems and clean spreadsheets for analysis.

2. Statement Preparation Support

They prepare draft versions of cash flow statements, income statements, and balance sheets based on organized records.

3. Bank Reconciliation and Transaction Matching

Assistants reconcile statements, identify mismatches, and maintain financial consistency.

4. Report Formatting and Dashboard Creation

VAs transform complex data into easy-to-read tables, visualizations, and presentations.

5. Ongoing Documentation and Audit Support

Assistants maintain audit trails, label files, and organize documentation for compliance reviews.

TaskVirtual: Your Partner in Financial Accounting Analysis

At TaskVirtual, our virtual assistants specialize in supporting financial analysis services with accurate, efficient, and reliable financial accounting tasks.

Our VAs offer:

- Financial data entry and cleanup

- Bank reconciliation

- Ledger organization

- Monthly and quarterly reporting support

- Financial ratio preparation

- Spreadsheet management

- Audit-ready documentation support

- Cash flow monitoring assistance

With 364+ client reviews and a 4.7-star satisfaction rating, TaskVirtual provides dependable accounting analysis support that helps businesses reduce operational costs and improve financial clarity.

Starting at $3.12 per hour, our virtual assistants deliver high-quality accounting support without the overhead of full-time staff.

Final Thoughts on Financial Accounting Analysis

Financial accounting analysis is essential for making better business decisions, maintaining healthy cash flow, and maximizing profitability. When done consistently and accurately, it becomes one of the strongest foundations for strategic growth.

Virtual assistants make the process more efficient by handling data entry, reconciliation, reporting, and documentation — allowing financial leaders to focus on deeper analysis and decision-making.

With TaskVirtual at your side, businesses gain reliable accounting support that enhances accuracy, transparency, and performance.

FAQs

1. What is the purpose of financial accounting analysis?

To evaluate performance, profitability, liquidity, and overall financial health.

2. Can virtual assistants manage accounting tools?

Yes — VAs work with QuickBooks, Xero, Zoho Books, FreshBooks, Excel, and ERP systems.

3. How often should financial analysis be done?

Monthly, quarterly, and annually — depending on business size and industry.

4. Can VAs help with audit preparation?

Absolutely. They organize documents, maintain records, and support compliance processes.

5. Why choose TaskVirtual for financial accounting support?

Because our VAs deliver accuracy, consistency, and cost-effective financial support that strengthens business decisions.

Great post! Really helpful insights on how virtual assistants support financial accounting and analysis. I found the points about streamlining data entry and improving reporting especially useful. Thanks for sharing!