How Business Tax Preparation Services Simplify Your Tax Responsibilities

Business Tax Preparation Services assist companies in managing, preparing, and filing their taxes accurately and on schedule. These solutions cover planning, compliance, deductions, and filing, ensuring that businesses minimize liabilities while avoiding costly penalties. By leveraging professional expertise, organizations can focus on growth while staying compliant with tax regulations.

What Are Business Tax Preparation Services?

Running a business comes with numerous tax obligations, which can feel overwhelming without proper support. Business Tax Preparation Services simplify this process, reducing the burden of tax season. They provide expert assistance to ensure every filing is accurate, compliant, and optimized for maximum savings. These services are specialized solutions designed to help businesses calculate, prepare, and file taxes in line with federal, state, and local laws. They promote accurate reporting, maximize eligible deductions, and reduce the likelihood of audits or penalties.

Unlike basic filing tools, Business Tax Preparation Services deliver end-to-end support, including strategic tax planning, bookkeeping integration, and advisory services for financial decisions. They are valuable for companies of all sizes—from startups to large enterprises—seeking financial precision and compliance.

How Business Tax Preparation Services Work

Understanding how these services operate allows businesses to see the advantages of outsourcing tax responsibilities. The process is structured to ensure compliance and accuracy at every stage. With professional oversight, companies can trust that their taxes are correctly managed from beginning to end.

1. Information Gathering

Tax professionals collect essential financial records such as income statements, expense reports, payroll details, and past tax filings. Precise data is critical for accurate calculations and compliance. Supporting documents like receipts and invoices are also reviewed to prevent missed entries. This stage further helps identify possible deductions early, streamlining later processes.

2. Tax Calculation and Compliance

Providers determine tax liabilities based on current legislation, ensuring compliance with federal, state, and local requirements. This includes corporate income tax, payroll tax, sales tax, and other relevant obligations. They also stay updated on legal changes, preventing outdated filings. Errors such as double taxation or incorrect categorization are avoided to reduce financial risks.

3. Identifying Deductions and Credits

Specialists examine financial records to uncover deductions and credits that can lower taxable income. This improves cash flow and maximizes savings. Both large and small claims, ranging from business travel to R&D credits, are correctly applied. Documentation is also prepared to make deductions audit-ready.

4. Filing and Submission

After calculations, providers prepare and submit tax returns either electronically or on paper. This ensures timely compliance and prevents late penalties. Every entry is carefully verified before submission to reduce mistakes. In addition, digital filing records are stored for future reference and reporting.

5. Audit Support

Professional services assist businesses during audits, helping them respond to queries, provide necessary documentation, and resolve issues efficiently. They serve as representatives in tax authority interactions, lowering stress levels for business owners. Their knowledge ensures that responses are strategic and well-structured to protect company interests.

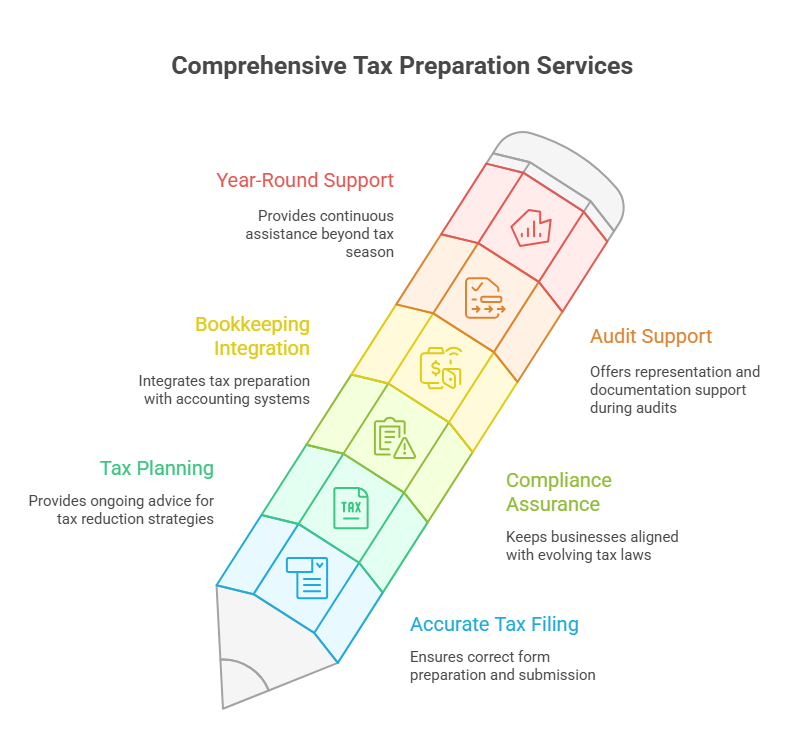

Key Features of Business Tax Preparation Services

Business Tax Preparation Services stand out because they offer far more than just filing. With a blend of advanced technology and financial expertise, these features guarantee compliance and financial stability. They not only simplify the complexities of tax season but also provide year-round guidance to strengthen financial decision-making. By combining automation with expert insights, these services minimize human errors while improving accuracy. Ultimately, they create a structured system that helps businesses remain compliant, save money, and focus on growth without being overwhelmed by tax obligations.

1. Accurate Tax Filing

All forms are prepared and submitted correctly to minimize errors and penalties. Providers use sophisticated software for cross-checking data and monitor deadlines closely to ensure no obligations are missed. They also validate supporting documents like receipts and invoices to avoid missed entries. This ensures businesses maintain an audit-ready record while reducing the risk of costly mistakes.

2. Tax Planning

These services provide ongoing advice on credits, deductions, and strategies to reduce liability. Planning extends beyond year-end filing, giving businesses continuous guidance for financial decisions that lead to long-term tax savings. Experts also help forecast potential tax liabilities for future periods. This proactive approach allows companies to make informed strategic investments.

3. Compliance Assurance

Regular compliance checks keep businesses aligned with evolving tax laws. Strategies are customized for industry-specific regulations, lowering the chance of penalties. Providers stay updated with federal, state, and local changes to prevent outdated filings. They also advise on compliance best practices, safeguarding the business from unexpected legal issues.

4. Bookkeeping Integration

Tax preparation is integrated with accounting systems for seamless financial management. Income, expenses, and filings are synced together, creating a complete financial overview for the business. This reduces manual errors and ensures that all financial data is consistent across platforms. Businesses can track financial performance in real time while staying compliant.

5. Audit Support

When audits occur, experts offer direct representation and documentation support. They take charge of communications with tax officers, ensuring smoother resolution of disputes. Professionals also prepare detailed audit-ready records for all deductions and credits claimed. Their guidance reduces stress and potential liability during the audit process.

6. Year-Round Support

Assistance continues beyond tax season, with ongoing consultations to optimize financial results. Mid-year adjustments are recommended to reduce last-minute stress and improve compliance. Businesses also receive strategic advice on upcoming financial decisions. Continuous support ensures optimized tax outcomes and long-term financial planning.

Benefits of Using Business Tax Preparation Services

The benefits of outsourcing go beyond accuracy and compliance. Businesses gain time, peace of mind, and financial optimization advantages that DIY filing often lacks. Professional tax experts also bring industry-specific knowledge that ensures every deduction and credit is maximized. In the long run, this strategic support helps businesses save money while building a stronger financial foundation.

1. Accuracy and Compliance

Professional oversight greatly reduces filing errors, ensuring legal compliance and preventing penalties. Potential issues are detected and addressed before submission. Experts also verify supporting documentation to ensure all deductions and credits are valid. This thorough review minimizes the risk of audits and financial discrepancies.

2. Time Savings

Delegating tax preparation frees businesses to concentrate on operations. Teams no longer waste hours on tax forms, which boosts overall productivity. Automation and streamlined processes also reduce repetitive tasks. This efficiency allows staff to focus on strategic initiatives and core business growth.

3. Maximized Deductions

Experts ensure no deduction or credit is overlooked, cutting down liabilities significantly. Claims are also structured in audit-proof formats. Tax professionals continuously monitor applicable credits and incentives. This proactive approach helps businesses capture savings they might otherwise miss.

4. Reduced Stress

ChatGPT said:

5. Financial Insights

Providers deliver valuable insights into financial health, identifying spending trends and profitability factors. These insights help businesses optimize their budgets and strategies. Detailed reports highlight areas for cost reduction and efficiency improvement. Companies can make data-driven decisions for sustained growth.

6. Audit Protection

With professionals on hand, businesses remain audit-ready. Guidance during audits lowers risks and strengthens credibility with tax authorities. Experts prepare thorough documentation and represent the business if needed. This ensures smoother resolution and protects the company’s financial reputation.

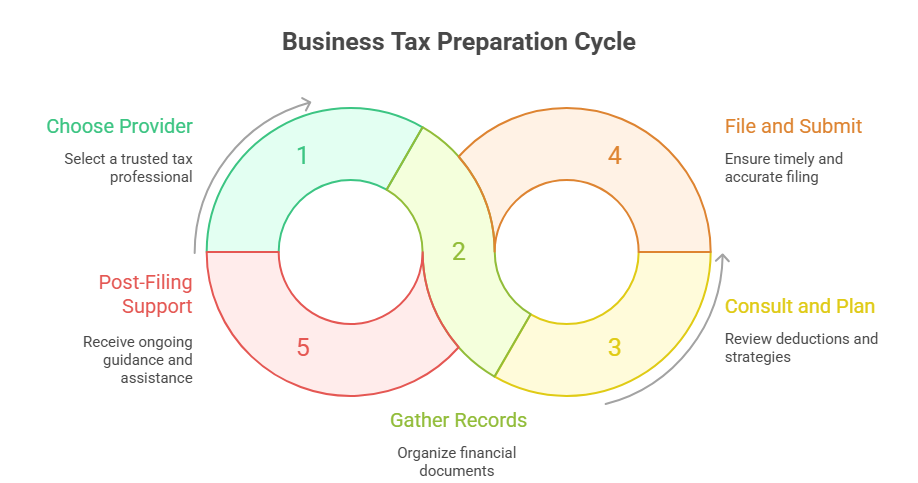

How to Use Business Tax Preparation Services

To get the most from Business Tax Preparation Services, companies must follow a coordinated process. This ensures efficiency and maximizes tax savings. A structured approach also reduces the chances of missing deadlines or overlooking important documentation. By collaborating closely with tax professionals, businesses can unlock long-term advantages beyond just annual compliance.

1. Choose a Provider

Select a trusted provider with industry-specific expertise and strong client feedback. The right partner ensures reliable, long-term support. Researching credentials and client testimonials helps verify credibility. A knowledgeable provider can also advise on industry-specific tax nuances and best practices.

2. Gather Financial Records

Maintaining organized financial records is essential for accurate tax filing and informed business decisions. The IRS states that proper record-keeping helps track income, deductible expenses, and supports accurate tax reporting. SECU notes that well-kept records provide insights for evaluating opportunities and managing risks. Additionally, inaccurate records can reduce productivity by 21.3%.

3. Consultation and Planning

Collaborate with the provider to review deductions, credits, and compliance strategies. Early consultation leads to higher savings and clearer planning. Providers can also forecast potential tax liabilities for upcoming periods. This proactive approach allows businesses to make informed financial and strategic decisions..

4. Filing and Submission

Allow professionals to complete forms and submit returns on your behalf. This ensures timely filing and fewer chances of errors. Electronic filing options reduce delays and improve tracking. Providers also double-check all entries to ensure accuracy before submission.

5. Post-Filing Support

Take advantage of year-round support, including consultations and audit assistance. Continuous guidance ensures smoother tax management in future cycles. Providers monitor ongoing compliance and advise on mid-year adjustments. This ongoing support helps businesses optimize tax results and avoid last-minute filing stress.

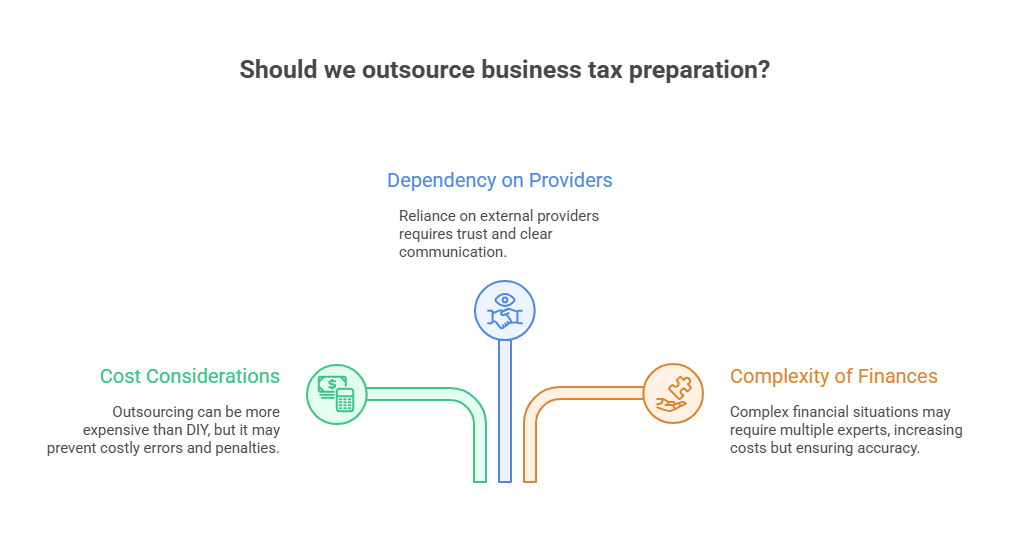

Limitations of Business Tax Preparation Services

While highly beneficial, there are limitations that businesses should weigh before outsourcing. Costs may be higher than DIY options, especially for smaller firms with simple tax structures. Additionally, businesses must rely heavily on the accuracy and timeliness of the service provider. Establishing trust and choosing the right partner are therefore essential to avoid potential risks.

1. Cost Considerations

Hiring a CPA for business tax preparation typically costs between $500 and $1,500, depending on the complexity of the return and the business structure. For instance, preparing an S Corporation tax return averages $903. While these services may be more expensive than DIY filing, they can prevent costly errors and penalties, offering long-term savings. Investing in professional tax preparation ensures compliance and can optimize financial outcomes.

2. Dependency on Providers

Relying on external providers means depending on their reliability and communication. Selecting a transparent and dependable partner is crucial. Clear agreements and regular updates help maintain trust. Businesses should establish communication protocols to ensure timely submission and accurate filings.

3. Complexity of Financial Situations

Complex finances may require multiple experts, which could raise costs. However, this additional investment ensures higher accuracy and compliance. Specialized expertise helps navigate niche tax rules and unique deductions. Engaging experts reduces the risk of errors in complicated financial scenarios.

How TaskVirtual Can Help with Business Tax Preparation Services

TaskVirtual provides expert Business Tax Preparation support, ensuring companies remain compliant while optimising financial outcomes. By combining human expertise with AI-powered insights, TaskVirtual helps businesses save time, reduce risks, and maximize deductions with accuracy and efficiency.

1. Expert Consultation on AI-Powered Efficiency

TaskVirtual assists businesses in adopting AI tools that enhance tax workflows. From automated expense categorisation to predictive tax liability estimates, their virtual assistants ensure financial data is processed with precision. This allows companies to avoid errors and meet filing deadlines consistently.

2. Professional Tax Planning and Documentation Support

With a team experienced in financial coordination, TaskVirtual provides structured tax planning, record organization, and documentation management. Their support helps businesses identify deductions, manage compliance, and stay prepared for audits without extra stress.

3. Audit Readiness and Compliance Monitoring

TaskVirtual’s virtual assistants proactively monitor financial documentation and ensure alignment with tax regulations. By offering detailed audit support and compliance checks, they strengthen financial security and minimize risks of penalties or disputes.

4. Affordable and Scalable Services

TaskVirtual offers services at competitive rates—starting as low as $3.12/hour to $14.99/hour making professional tax support accessible to startups, SMBs, and enterprises alike. Their flexible plans allow businesses to scale assistance based on financial complexity and seasonal needs.

5. Proven Reliability and Client Trust

With 364 positive reviews and a 4.7-star rating on leading VA reviewing platforms, TaskVirtual is recognized for dependable, high-quality financial services. Their consistent results demonstrate trust and reliability in handling sensitive tax responsibilities.

By partnering with TaskVirtual, companies gain a cost-effective yet professional extension to their finance team. This ensures accurate tax preparation, stronger compliance, and more time for leaders to focus on business growth.

Conclusion

Business Tax Preparation Services are essential for companies that want accurate, compliant, and efficient tax management. They combine strategic planning, expert filing, and audit support to meet regulations while optimizing financial results. By outsourcing, businesses save time, reduce stress, and gain deeper financial insights. Whether for small firms or large organizations, these services provide a reliable way to handle tax obligations effectively.

FAQ: Business Tax Preparation Services

1. What are Business Tax Preparation Services?

They are professional services that help businesses prepare, calculate, and file taxes accurately while complying with tax laws.

2. Why should my business use these services?

They minimize errors, save time, optimize deductions, and provide audit support, letting businesses stay focused on core functions.

3. Can these services handle all types of business taxes?

Yes, providers manage income tax, payroll tax, sales tax, and other relevant business taxes.

4. Do I need an accountant if I use these services?

Not necessarily. These services can supplement or even replace in-house accounting for tax filings.

5. How do these services help with audits?

Hey prepare documentation, provide guidance, and represent businesses during audits to reduce risks and ensure compliance.